What Are Short-Term Rental Loans?

If you’re looking to purchase a property to list on Airbnb or Vrbo, you’re likely seeking a short-term rental loan. Visio’s vacation rental program uses a debt-service coverage ratio (DSCR) loan to qualify your investment property based on its cash flow rather than your personal income. Our short-term rental loans are the market leader for self-employed investors and those growing a portfolio of vacation rental properties.

Short-Term Rental Loan Options

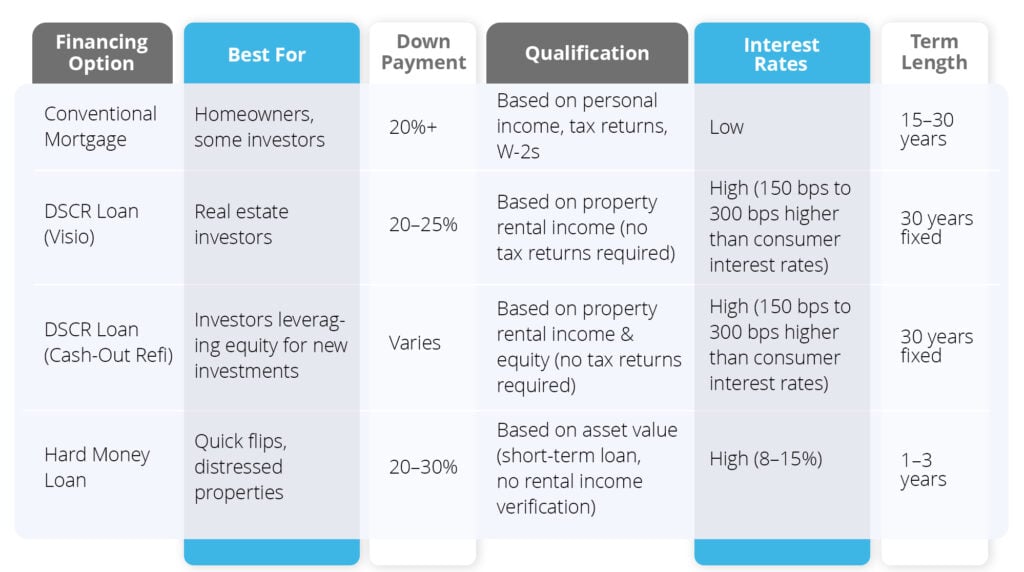

Investors have multiple financing options for short-term rental loans. Below, we’ve outlined a few choices and explained why our DSCR loans are often the best fit.

We’ve broken down each loan type into three sections:

Who: The typical investor who uses this loan

How it works: The basics of how the loan functions

Why investors choose it: The key reasons this loan is a good fit

Conventional mortgage loan

- Who: Homeowners buying a vacation home for occasional rental use

- How: Qualification requires a 20% down payment and other personal financial evaluations

- Why: Low interest rates but strict qualification criteria based on personal finances

Lenders require personal income verification, tax returns and W-2s to ensure you can afford two mortgages. Additionally, many conventional lenders don’t count short-term rental income for qualification, making it harder for investors to finance multiple properties.

DSCR loans

- Who: Investors buying short-term rental properties to operate as income-generating assets

- How: Qualification is based exclusively on the property’s rental income, not personal finances

- Why: Investors can get flexible, scalable financing without traditional mortgage hurdles

DSCR loans don’t require tax returns or personal income verification to qualify. Investors can borrow under an LLC or corporate entity for liability protection. Unlike other loan types, they offer 30-year fixed terms with no balloon payments.

Also, these loans can be used to refinance an existing rental property or take out cash for a down payment on additional properties, helping investors scale their portfolios.

Hard money loan

- Who: Experienced investors needing quick access to capital for acquisitions, renovations or short-term bridge financing

- How: Approval is based on the property’s asset value rather than income, with higher interest rates and shorter repayment terms (typically between six and 36 months)

- Why: Best for investors with a clear exit strategy, such as those flipping a property or securing short-term financing before transitioning to a long-term loan.

Hard money loans offer a fast funding solution, but their high interest rates and short repayment periods make them better suited for fix-and-flip projects or temporary financing rather than as a long-term solution for short-term rentals.

Why DSCR Loans Are the Best Fit for Real Estate Investors:

Why Invest in Short-Term Rentals With Visio?

With services like Airbnb and Vrbo firmly established in the real estate economy, short-term rental properties can be a lucrative strategy for investors. Visio offers purchase and refinance loans up to 80% loan-to-value (LTV). Since 2012, Visio has financed more than $3.5 billion in DSCR loans, including over $990 million in vacation rental properties.

Short-Term Rental Loan Benefits

A short-term rental loan may be a viable option for you. Let’s dive deeper to discuss the advantages of vacation rental loans through Visio.

Simple underwriting process

Traditional lenders often hesitate to finance short-term rental properties due to fluctuating income, seasonal demand and a lack of long-term leases. Visio evaluates properties based on real-world rental performance—using historical short-term rental income or market-based projections—rather than income calculations that don’t account for how vacation rentals operate.

Full 30-year terms

Many investment property loans include balloon payments, which require a lump sum payoff after a set period. As a result, investors may be forced to refinance or pay off the loan earlier than intended. Visio’s DSCR loan comes with a 30-year fixed term, so you can focus on growing your portfolio without worrying about sudden large payments or loan restructuring down the line.

No tax returns required

Most traditional mortgage lenders require tax returns, W-2s and detailed financial records to approve a loan, making it difficult for self-employed investors to qualify. Visio’s DSCR loans don’t require personal income verification. Investors can secure financing based on the property’s income potential rather than their tax filings.

Straightforward, dependable pricing

Real estate investors need clear and predictable financing to make informed decisions, but many lenders have complex pricing structures with hidden fees or fluctuating rates. Visio offers transparent, standardized pricing, so you always know what to expect.

Borrow through a corporation

Many short-term rental investors finance properties through an LLC or corporate entity to limit personal liability, safeguard their assets and streamline tax benefits. Visio allows you to borrow under a corporate structure, ensuring that your personal credit, identity and financial well-being remain separate from your investment properties.

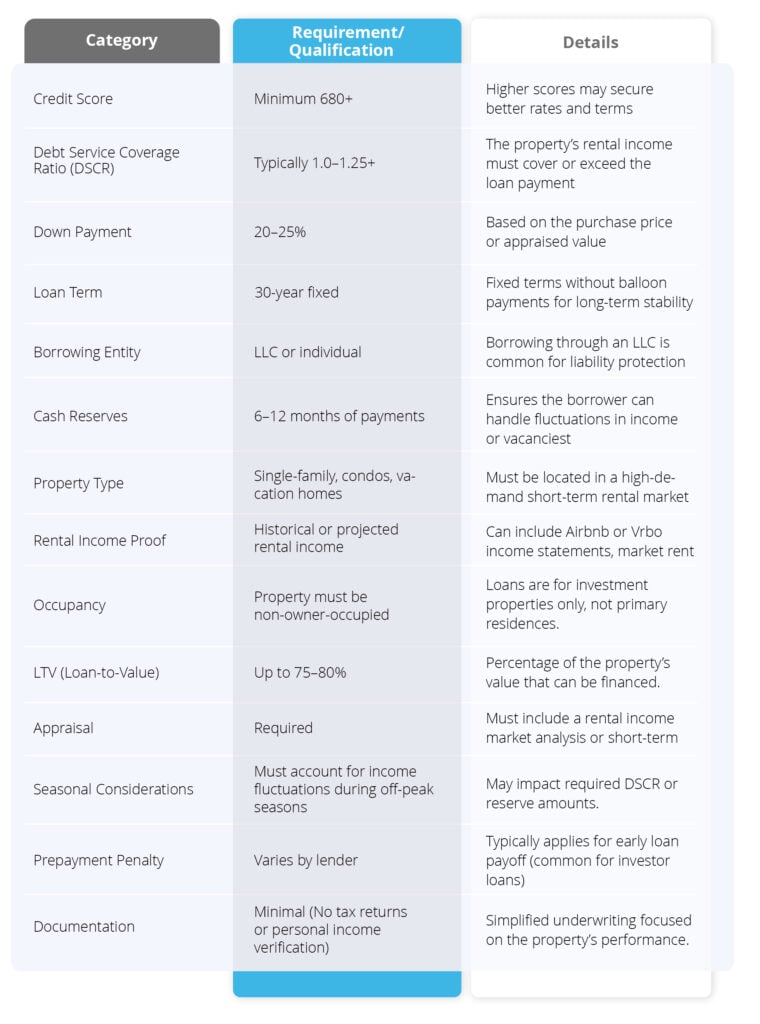

How To Qualify for a Short-Term Rental Loan

Visio’s mastered the short-term rental loan process, providing over $990 million in loans to investors looking to develop a strong income through vacation rental properties.

How To Prepare for a Short-Term Rental Loan

Visio’s qualification requirements are straightforward. Investors can follow four steps to ensure success.

1. Do your research

Compare different locations and markets before making a decision. The goal is to find which state, region and property provides the greatest opportunity for profit. Consider factors such as property values, occupancy rates and average nightly rates. Gathering as much information as possible can provide a clear picture of cash flow, ROI and cash-over-cash return.

2. Prepare for the down payment

Due to the increased risk to the lender, short-term rental loans generally require investors to put more down upfront. Down payments can vary depending on the lender and other varying factors, but you can expect to put down between 20% and 25% of the property’s purchase price. If your credit is less than stellar, you may be asked for as much as 35% down.

3. Make sure your property meets funding requirements

Funding and credit requirements are higher for a second home than for a primary residence. Ensure that your vacation property meets these minimum thresholds:

- Minimum property value of $150,000

- Minimum loan value of $75,000

- Minimum credit score of 680

- No bankruptcies in the last four years

- No foreclosures within the last three years

4. Gather necessary documentation

Since tax returns and pay stubs aren’t required when applying for a short-term rental loan, lenders require different types of documentation, which include:

- One form of ID for each guarantor

- Voided check

- Insurance declaration page

- Lender’s title insurance policy

- Business entity documents (if borrowing through a company)

- HOA contact information (if applicable)

- Current lender details (for cash-out refinances)

- Purchase contract

- Any addenda to the purchase contract

Additionally, a property appraisal is required to confirm rental market value and ensure DSCR thresholds are met.

5. Ensure the property is rent-ready

Visio requires short-term rental properties to be rent-ready and in C4 condition, meaning they must be fully functional, structurally sound, clean and well-maintained. If your property needs major construction or renovations, you’ll need to secure financing from a different lender.

Short-Term Rental Loan FAQs

What is a short-term rental property?

A short-term rental is a residential property rented for periods ranging from one night to several weeks. This includes listings on platforms like Airbnb and Vrbo, as well as rentals managed independently. The property can be a primary home rented occasionally or a dedicated investment used exclusively for short-term stays.

What financing options are available for short-term rental properties?

Financing options for short-term rental properties include:

- Conventional loans: Traditional mortgages that require income verification and generally a 20% down payment

- DSCR loans: A DSCR loan type assesses the property’s income potential rather than the borrower’s personal income, often not requiring tax returns

- Specialized vacation rental loans: Tailored loans designed specifically for vacation rental properties, offering features like 30-year terms and fast closing times

What are the typical down payment requirements for a short-term rental loan?

Down payment requirements may vary by lender and loan type. For DSCR loans, down payments generally range between 20% and 25% of the property’s purchase price. Specialized vacation rental loans may have similar requirements, but check with the lender for exact details.

How is the loan qualification process different for short-term rental properties?

Unlike traditional loans that focus on the borrower’s personal income and debt-to-income ratio, certain loans for short-term rentals, like DSCR loans, evaluate the property’s income-generating potential. This means lenders assess the expected rental income to determine loan eligibility, often eliminating the need for personal income verification.

Are there specific credit score requirements for obtaining a short-term rental loan?

Credit score requirements vary by lender. For example, some lenders may require a minimum credit score of 680, along with other criteria, such as no recent bankruptcies or foreclosures. It’s recommended to check with individual lenders for specific credit requirements.

Can I refinance my existing property to invest in a short-term rental?

Yes, many investors use cash-out refinancing to leverage the equity in their existing properties to purchase or improve short-term rental properties. This strategy allows for portfolio expansion without the need for additional capital.

What factors should I consider when choosing a location for my short-term rental investment?

Key considerations include:

- Market demand: Assess the popularity of the area among travelers

- Local regulations: Understand any restrictions or requirements for short-term rentals

- Proximity to attractions: Properties near tourist attractions, business centers or universities may have higher occupancy rates

- Seasonality: Consider how seasonal trends might affect rental income

Conducting thorough market research and consulting with local real estate experts can provide valuable insights. Read more Short-term Rental Stats to learn more about this topic.

Are there any restrictions on the number of short-term rental properties I can finance?

Some lenders have limits on the number of properties an investor can finance. However, certain programs are designed to be scalable, with no hard limit on the number of properties. It’s important to discuss your investment goals with your lender to understand any potential limitations.

How do interest rates for short-term rental loans compare to traditional mortgages?

Interest rates for loans on short-term rentals are generally higher than those for owner-occupied homes. This is due to the perceived higher risk associated with investment properties. Rates may vary based on the lender, loan type and the borrower’s credit profile.