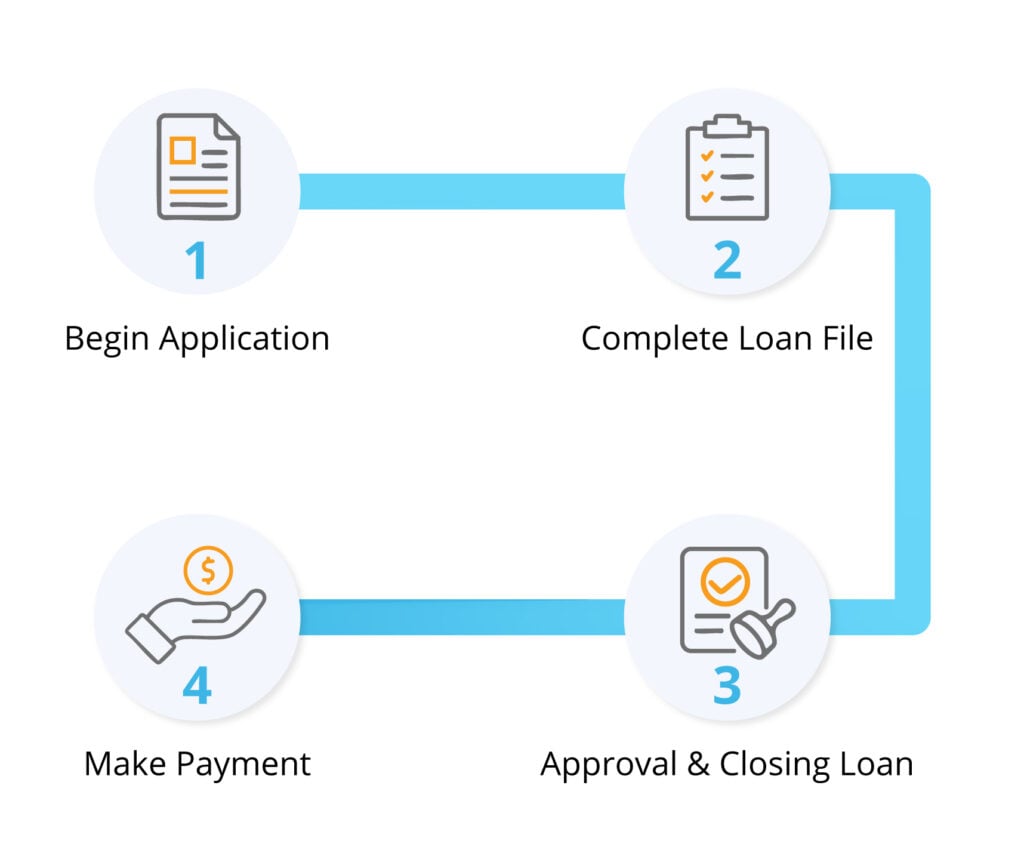

Our Lending Process

Fast, simple and efficient

As one of the nation's leaders in DSCR loans, Visio Lending has perfected and streamlined the DSCR loan process. Our simplified process allows us to provide quick turnaround times, flexible loan options and seamless access to our broker and investor portals to track loans, calculate pricing and manage applications.

From the initial application to closing, a dedicated Visio team member is with you every step of the way. Check out our step-by-step guide to see how easy it is to secure your DSCR loan in just four simple steps.

- Account Executives

- QC Specialist

- Underwriter

- Servicing

- Closer

- Processor

Begin Your Application and Submit Initial Documentation

Visio will collect your loan application and other documentation to determine eligibility and expected financing terms. We’ll also order your appraisal and perform a preliminary background check.

How to avoid delays

- It's important to provide us with accurate estimates of property value, rent and credit score. Any deviations in actuals from estimates will change the terms of your loan

- Make sure your ID is not expired and will remain valid until the loan is funded

- Account Executives

- QC Specialist

- Underwriter

- Servicing

- Closer

- Processor

Our loan application helps determine if you qualify for the requested loan. It includes five sections:

- Personal information

- Loan details

- Property information

- Business strategy

- Summary

You’ll complete and apply online. Once finished, we’ll send you a DocuSign version for signing.

Your credit score and experience factor into your loan eligibility and terms. To qualify, we require a minimum credit score of 680.

We'll pull a credit report that includes scores from the three main credit bureaus and calculate the median score. In addition to credit score, we also have minimum credit experience requirements. These are based on the number as well as the type and length of tradelines listed on the report.

If the property you're financing is held by a corporate entity, we'll assess the credit of the primary guarantor (PG) on the loan. The PG should be the individual primarily responsible for the property you're financing.

Visio will obtain a borrower’s authorization form, which is typical in mortgage lending. This document authorizes us to obtain and verify documents related to the loan file, such as current mortgage payoffs.

The Visio sales team will order an appraisal after we've determined qualification based on the application and credit analysis. Since the appraisal process is critical in verifying the property’s value and ensuring it meets our requirements, the borrower must pay for the appraisal in full. All appraisals ordered by Visio are good for 120 days.

Visio requires a minimum of one form of an unexpired government-issued photo identification. Your identification may include:

- State-issued driver's license or identification card

- U.S. passport or passport from a foreign country

- U.S. military card

- Resident alien card (Must provide nationality or residence and contain a photograph or similar safeguard)

We may request an additional form of identification, which could consist of a second primary above or any of the following:

- Marriage license

- Current utility bills

- Social Security card

- Medical or insurance card

Note: Visio does not lend to foreign nationals or non-permanent resident aliens.

For purchase loans, Visio requires a fully signed purchase contract with all initial and signature lines completed by both the buyer and seller. The vesting information must match the buyer listed on the contract exactly. If there are any discrepancies in the buyer's name or changes to the purchase price, an addendum will be required.

We aim to close your loan within 30 days. To guarantee this timeline, the purchase contract must have at least 30 days remaining. If fewer than 30 days remain, an extension will be required. Additionally, the individual signing on the buyer’s behalf must have the authority to do so.

Compile a Complete Loan File

Visio works with you and other third-party entities to compile and review a complete loan file, verifying eligibility and terms.

Helpful loan file information

- Make sure you carefully review and complete the required disclosures in your loan application

- Tell your account executive upfront if you have a felony conviction or pending criminal charges, so we can make an early determination of eligibility

- Ensure there are no delinquent taxes or pending tax sales. Please, alert us if so

- Be prepared for a potential amendment to your current insurance coverage if we determine that the property is located in an area more likely to be impacted by perils such as flood, wind or earthquakes

- File any required government annual entity reports and make sure your entity is in good standing before starting the loan process

- Account Executives

- QC Specialist

- Underwriter

- Servicing

- Closer

- Processor

We perform background checks on each loan application. We’re looking for any outstanding judgments, bankruptcies, criminal activity or civil litigation. We also check government databases in connection with anti-money laundering and other federal and state requirements.

We only offer first-lien mortgages and don't permit any other outstanding property encumbrances at funding. We'll review the preliminary title commitment prepared by an approved title company to verify your property ownership details, including any outstanding liens and encumbrances, such as current mortgages or other encumbrances.

Before closing, we’ll work with the title company to make sure we'll be in the first lien position on your property upon loan funding.

We require the past year's property taxes to be paid in full and provisions for future tax liability are escrowed as part of the monthly payment. The title company will provide a tax certificate outlining the taxing authorities, payment frequency, payment amount and delinquent tax amounts.

The tax certificate should include the Tax ID, parcel information, property address, taxing authorities, good through dates for any delinquent tax amounts and information for any pending tax liens.

In some cases, we may request a tax bill from you to supplement the information provided by the title company.

Most standard homeowners policies (HO-1, etc.) don't provide sufficient coverage as they don't adequately protect landlords. Our insurance guidelines require that all buildings be covered under a standard extended coverage endorsement against loss and additional hazards that are typical for the property location.

Coverage must equal 100% of the insurable value of the property or the loan amount, but no less than the minimum amount necessary to fully compensate for any damage or loss on a replacement cost basis. Dwelling Policy 3 (DP3) or similar is typically sufficient. Additional restrictions and requirements may apply.

In addition to our standard insurance requirements, we also require flood coverage if it's determined that your property is located in a flood zone or is potentially subject to additional perils, such as wind or earthquakes.

For properties located in Georgia, Hawaii, Illinois, Massachusetts, New Jersey, New York, Pennsylvania and Virginia, we require loans to be completed in legal entities (corporation, LLC, limited partnership, limited liability partnership or registered general partnership).

However, it's optional if the property is located in any other state. We'll ask for information about your legal entity on your application and in a subsequent questionnaire.

We'll match that information against information contained in your entity's organizational documents filed with the state and information we obtain from state records. Based on all of that information, we'll prepare an incumbency certificate detailing the ownership of your entity and signing authority for your loan.

We'll require you (and other entity owners) to sign a personal guarantee stating you personally are responsible for loan repayment. If you're married, we may require your spouse to sign a document consenting to your execution of the personal guarantee.

We require reserves equal to six months of mortgage payments. For purchases and no cash-out refinances, cash to close is required in addition to reserves. We prefer instant banking verification (IBV) for fund verification, but may accept bank statements in rare cases. Acceptable accounts include:

- Cash balance accounts

- Certificate of deposit (CD)

- Investment accounts

- Retirement accounts (70%)

- Trust accounts (50%)

Note: For cash-out refinances, the cash-out funds can be used to meet reserve requirements.

Approving and Closing Your Loan

Visio approves your loan and coordinates closing and funding with an approved title company.

Key closing details to remember

- Use a consistent signature for each document

- Accurately date each document

- We require all documents to be signed with blue ink

- Account Executives

- QC Specialist

- Underwriter

- Servicing

- Closer

- Processor

In most cases, an electronic signature request will be sent to you via DocMagic on the day of closing. The title company has access to the loan documents and will assign a notary (if necessary) to oversee the signing of closing documents, ensuring proper witness and legal compliance.

After the signatures are collected, the documents are reviewed to confirm that all required signatures and dates are present and that your information is correct.

For all loans, Visio reviews the signed loan documents before funding is issued. Funds are typically sent to the title company the same day as closing or within 24 to 48 hours after the funding number is issued.

While many lenders offer same-day funding or rushed closings, we have found that rushing tends to lead to costly errors for all parties involved.

For example, if there's an error post-closing, the lender must identify it, reissue documents, notify all parties and adjust funding. To avoid unnecessary delays and complications, we take additional time up-front to catch any potential errors early. This approach ensures a smoother and more efficient closing process.

Make Your Payments

You’ll submit your monthly loan and escrow payments to a loan servicer responsible for payment collection and accounting.

Important payment reminders

- Set up ACH for your monthly payment

- Update your ACH if you change bank accounts

- Payments must be received by the 16th of each month to remain eligible for future loans from Visio

- Account Executives

- QC Specialist

- Underwriter

- Servicing

- Closer

- Processor

A dedicated loan servicer handles all of our newly originated loans. You'll receive more information about the specific provider during the closing process. They'll be your primary contact for all servicing-related matters, including payments and escrow-related questions.

Payments are due on the 1st of each month and are considered late if not paid by the 16th of the month. By making timely payments each month on your loan, you remain eligible to borrow with Visio in the future.