A bridge loan, also known as gap financing, is a short-term financing option used to “bridge the gap” between the short-term funds and a permanent solution. These loans are typically used by homeowners and real estate investors to secure funds quickly and temporarily, ensuring that they don’t miss out on the ideal property or suffer financial strain due to overlapping mortgage payments.

Bridge loans are a fantastic option for investors looking for the flexibility to sell a property in the near future, but they are not the only option. In this post, we will go into detail about what bridge loans are, use cases, and how Visio Lending’s loan products can be used as alternatives.

What is a Bridge Loan and Why Do Investors Use Them?

As we previously stated, bridge loans are short-term loans which are often employed when investors need to bridge a financial gap during the transition from one property to another. Here are some common use cases:

Purchasing a New Property Quickly

Real estate investors may use bridge loans to acquire a new property before selling an existing one. This can be particularly useful when an investor identifies a lucrative investment opportunity but doesn’t have the necessary funds readily available.

Funding Renovations or a Rehab

A subset of bridge loans are fix and flip loans. A fix and flip loan typically includes both a purchase and a renovation or construction component. In this scenario, an investor will either sell the property at a higher value to pay off the loan or refinance the property as a rental into permanent financing.

Wholesaling Properties

Wholesale real estate investors work hard to find off-market deals that they can purchase at discounts to market values. Rather than renovating these off-market homes for resale or conversion to a rental property, they look to sell the home to another investor that will do the rehab. To fund the off-market purchase, wholesalers often use bridge loans. The key is to sell the property before the bridge loan is due.

Transitioning to Permanent Financing

Bridge loans are often used when an investor is in the process of securing a long-term mortgage but needs immediate funds to acquire a property. Once the long-term financing is finalized, an investor can pay off the bridge loan in full.

Key Characteristics of Bridge Loans

In all of our use cases for a bridge loan, there is one commonality: a temporary solution. In addition to expecting short-terms, often ranging from months to years, here are some other key characteristics of a bridge loan.

High Interest Rates

Bridge loans typically have higher interest rates than traditional mortgages because of their short-term nature.

Balloon Payments

Most bridge loans are interest-only loans, meaning you’ll only make interest payments during the loan term. The principal is usually repaid in full when your loan becomes due, which is known as a balloon payment.

Low LTVs

Getting an LTV of 65% on a bridge loan is considered high, in contrast with permanent financing LTVs go up to 80%.

Pros and Cons of Bridge Loans

To further understand the complexities of bridge loans, let’s delve into some of the benefits and drawbacks.

Benefits of Bridge Loans:

- Swift transactions: Bridge loans enable you to act quickly, providing investors with the flexibility to make competitive offers and secure deals.

- Flexibility: Real estate investors can use bridge loans for various purposes, such as purchasing new properties, renovating existing ones, or refinancing existing loans. This flexibility allows investors to adapt to their specific needs.

- Temporary funding solution: Bridge loans are a viable option for investors who need temporary financing while waiting for a more extended, traditional loan to be approved.

Drawbacks of Bridge Loans:

- High Costs: Bridge loans come with higher interest rates and additional fees, so it’s crucial to assess whether the benefits outweigh the costs.

- High Risks: Using bridge loans successfully depends on the success of your exit strategy. For example, if your existing property doesn’t sell as quickly as expected, you will have to pay the loan in full without the money from a sale.

Visio’s Better Bridge Loans

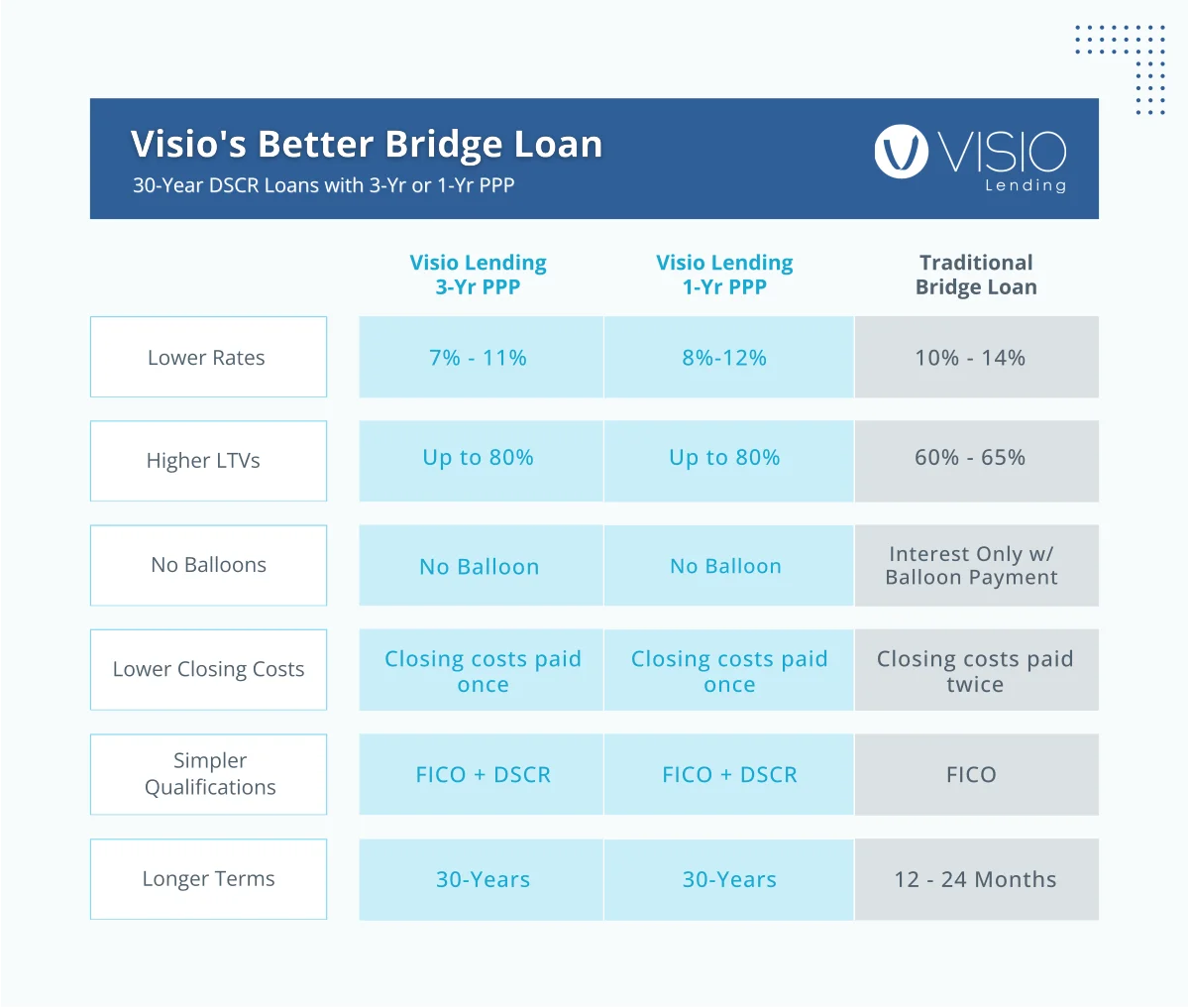

For real estate investors looking for the flexibility to sell an investment property in the foreseeable future without worrying about high interest or balloon payments, Visio Lending has the solution for you. With our 3-year and 1-year prepayment penalty option, investors can access a 30-year 30-year DSCR loan without paying a hefty fee if they pay off the loan early.

Compared to a traditional bridge loan, our loans have lower interest, higher LTVs, no balloon payments, lower closing costs, and longer terms. You can find out your DSCR using our online calculator.