Every real estate investor will have to pay taxes on their investments. At the same time, the tax code can be complicated, especially because much of the terminology is confusing. While it’s common for real estate taxes and personal property taxes to be used interchangeably, they are slightly different. The main differences lie in what is considered personal property and how the rates are calculated.

Below is a deep dive into real estate taxes vs property taxes so that you feel confident the next time tax season comes around.

What are real estate taxes?

In simple terms, real estate taxes are taxes paid on real estate, also called real property or immovable property. This would refer to immovable land as well as permanently affixed structures, like houses, garages, sheds, and gazebos. If you would need to demolish structures to remove them from land plots, then they are immovable assets.

Real estate taxes, also known as real property taxes, are determined by a tax assessor and are paid to the local government based on a local tax rate, which varies by area. Even city tax rates can be higher or lower than state or local levels, meaning you’ll need to carefully investigate the local areas before buying your investment.

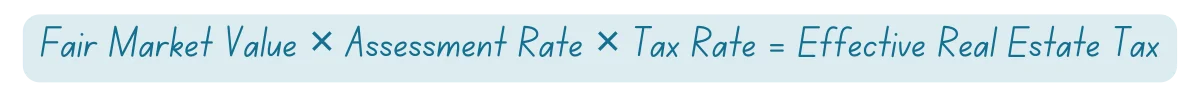

How are real estate taxes calculated?

Real estate taxes are based on your home’s assessed value, which is a percentage of its fair market value.

In other words, state and local governments will multiply your home’s market value by a predetermined percentage (the assessment rate), such as 65% — with the result showing your real property’s assessed value. After that, they will apply their specific real estate tax rate to the value. Here is the formula:

So, for example, imagine that you have a property with a market value of $300,000, and the assessment rate is 65%. Your tax assessment value would then be $195,000. Now, the real estate tax rate is 2.2%. Multiplying the tax assessment value by 2.2%, you would need to pay $4,290 in real estate taxes.

Highest real estate tax in the US

Real estate taxes vary widely across states. It’s often the high cost of real estate taxes that drives many homeowners away from certain states. Currently, New Jersey has the highest real property tax rates in the United States at 2.47%.

The close proximity to supercharged cities like New York, as well as the fact that land is scarce in this small state, creates an enormous annual tax bill for residents. Combined with the fact that property values are high, property owners have both a hefty monthly mortgage payment and intimidating tax returns.

Lowest real estate tax in the US

Surprisingly enough, it is Hawaii that has the lowest state tax rate, with residents paying just 0.29% in real estate taxes every year.

This is because Hawaii has a unique tax structure that relies more on general excise taxes than on real estate taxes to pay for things like schools and municipal buildings. This means that your business activities, such as rentals, will be more heavily taxed than elsewhere, making tax deductions even more important in Hawaii.

What are personal property taxes?

Personal property taxes refer to moveable assets, such as mobile homes, park model cabins, recreational vehicles, and cars. These are the same things as property taxes.

If you wouldn’t make monthly mortgage payments on it, you can theoretically move it, and it’s liable to annual vehicle registration — you’ll likely pay property taxes on it.

Why are property taxes lower than real estate taxes? Movable assets are generally cheaper in the first place, and they almost always depreciate. A mobile home built five years ago will be worth less than one built yesterday. This is not the same as for real property, which typically appreciates instead.

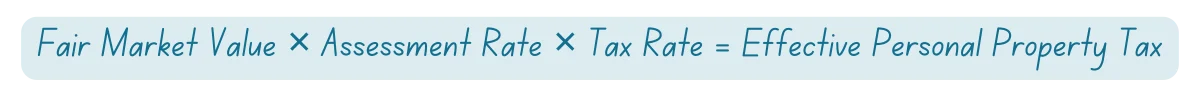

How are personal property taxes calculated?

Just like real estate, property taxes are calculated based on a percentage of the assessed value of the property. Although real estate taxes and assessment rates vary by area, the rates for property taxes are typically lower than for real estate.

For illustrative purposes, your assessed value may be just 35% of the fair market value. After you know the assessed value, multiply it by the tax rate, and you’ll get your final tax bill. The formula is the same as the one for real estate:

Let’s assume that you have a mobile home on your commercial property that you are using as an office while you oversee the construction of a home. You purchased it for $60,000.

With a personal property assessment of 35%, its assessed value is $21,000. We’ll then say that you have a 1% personal property tax rate, meaning the personal property taxes paid would be just $210.

In comparing real estate taxes vs property taxes, it’s important to note that there are far more exemptions that vary widely across states.

Typically, only property exceeding a certain value threshold will be taxed — your car worth only $15,000 may not have a high enough value to qualify. You may be able to reclassify the property to avoid paying property taxes, and depreciation means that the value tends to drop every year.

Highest personal property tax in the US

The highest tangible personal property tax rate is in Washington, DC, at 3.4%. This makes sense, given that as the center of power, high-priced goods move through the area every day. If you’re planning on buying expensive business equipment for use in the capital, you may be better off purchasing and keeping it in a nearby region, such as Maryland.

Lowest personal property tax in the US

https://visiolending.com/resources/location/ohio/The lowest tangible personal property taxes are zero, and seven states charge no personal property tax whatsoever. This includes Delaware, Hawaii, Illinois, Iowa, New York, South Dakota and Pennsylvania. Other states, such as New Hampshire, New Jersey, North Dakota, and Ohio, exempt nearly all property from this taxation, saving it only for special classes like utilities.

Real Estate Tax vs Personal Property Tax

Real estate taxes are charged on immovable property, which includes land and permanent structures like homes.

Personal property tax, also known as tangible personal property tax, is for assets that could theoretically be moved, such as mobile homes or recreational vehicles. Land is always subject to real estate, but as for structures, if you would have to dismantle it to move it, then it is likely considered real property.

Real estate taxes and property taxes can both significantly cut into your bottom line. However, real estate taxes are less open to interpretation, more expensive, and more strictly regulated. The assessed percentages tend to be much higher, as do the tax rates.

It’s important to be ruthless with deductions in order to compensate for high real estate taxes and to choose your area of purchase based on how much you can expect your annual taxes to be. On the plus side, you can often pay in installments, typically with a quarterly due date, to spread out the expenses more evenly and protect your bottom line.

On the other hand, personal property taxes vary significantly by state. Some states don’t charge it at all, while others only charge for more expensive assets of specific classes, such as commercial vehicles. They tend to drop over time because movable property is more likely to depreciate rather than appreciate in value.

Like real estate taxes, it’s based on a percentage of the assessed price, and then a tax rate is applied to this adjusted value. You have a bit more flexibility when it comes to tangible property, making it possible to avoid taxes based on assessments or on property structure.

For example, a good park model home may be just as nice as a small house, but it is classed as mobile property and is therefore not subject to a real estate tax. You have opportunities to get creative here, significantly lowering your bills.

Bottom Line

Both forms of taxation are based on percentages of assessed value, but they vary greatly in their application and overall tax burden. It makes it all the more important to do your research before choosing a state or municipality to purchase property to ensure you pay the lowest taxes possible while making the greatest return on investment.

If you’re ready to dive into the world of real estate investing, Visio Lending is here to help. We offer competitive rates and prompt turnaround times, helping you reduce your mortgage interest and expand your portfolio.

Contact us today to learn how we can assist you in achieving your dreams of rental ownership. We’ve helped thousands of investors across the country, and we look forward to assisting you, too.