-1.jpg?width=1920&height=1080&name=1%20-%20Blog%20Feature%20Image%20Dump%20(2)-1.jpg)

Effective gross income and net operating income are both important metrics when determining the profitability of a rental property, but they have different purposes. A property owner should calculate both in order to get a full picture of their rental income and overall cash flow.

.svg) Talk to an Investment Property Expert

Talk to an Investment Property Expert

What Is Effective Gross Income (EGI)?

Effective gross income (EGI) refers to the income generated by a rental property after factoring in other income, such as parking spots or coin-operated laundry machines, but before removing operating costs.

What Is Effective Gross Income (EGI) in Real Estate?

The effective gross income calculation assists real estate investors in getting a full picture of how much income the property generates.

How to Calculate Effective Gross Income (EGI)

Calculating effective gross income relies on carefully accounting both your profits and losses before you remove operating expenses. It takes into account every income-producing venture on your real estate property, including those beyond typical rental income, and predicts your losses due to vacancy or non-payment.

EGI Formula

The effective gross income (EGI) formula is very simple, composed of four elements:

- Potential Gross Income (PGI)

Potential gross income is the maximum amount of expected rental income in perfect conditions, where there is 0% vacancy and all tenants pay rent on time. The potential gross rental income would be the total of all the monthly rent you charge for every unit.

For example, if you have 10 units, and you charge each one $2,000, then your gross potential income is $20,000.Othe

- Other Income

These are the other things you charge for your rental properties, such as laundry facilities, parking fees, vending machines, or pet fees.

- Vacancy Costs

When you have multifamily properties, it’s likely that you will have at least some vacancies. The average for investment properties is a 5.8% vacancy rate per year across the entire complex.

Your vacancy cost is the lost income from vacant units, typically identified as the amount of rent you would have charged had the unit been filled.

- Credit Costs

Unfortunately, not every tenant will pay their rent. They may fall on hard times and struggle to honor their commitments. For your balance sheet, this is essentially the same as a property being vacant, so it is often rolled into vacancy rates for official statistics.

To begin identifying your effective gross income, gather all your lease agreements, which will provide you with your gross potential rental income.

You’ll next identify all other income-producing ventures on your investment property. These can be easily overlooked as they are generally passive income, so review your profit and loss statements to ensure that you’re not missing anything. This provides you with your property’s potential income in full.

Next, assess your vacancy and credit costs. If you’re a new real estate investor, you can find this in financial statements from the previous owner, but if it’s a new construction, you can often find an annual figure from similar properties in the area. Other property owners and property managers can also assist you in creating a realistic estimate for the area.

Effective Gross Income (EGI) vs Net Operating Income (NOI)

Both effective gross income and net operating income are important components of identifying your total income, as they work hand in hand.

Calculating net operating income involves taking the gross annual rental income and subtracting operating expenses. The main elements of total operating expenses include the following:

- Property management fees

- Property taxes

- Property insurance

- Repairs and maintenance

- Utilities

- Staff salaries

These are all subtracted from the effective gross income to calculate net operating income.

For deeper analysis, an investor may also identify gross operating income, which includes debt service, such as mortgage payments and loans, and capital expenditures for things like park benches or trash cans.

When purchasing a property, an investor can use EGI and NOI to identify the cap rate, which helps them decide whether the property’s sale price is worth the investment.

Effective Gross Income (EGI) Calculation Example

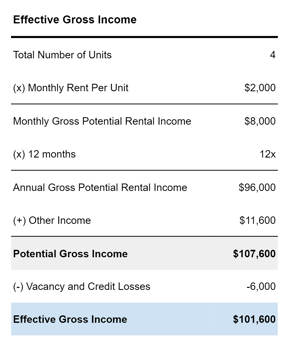

To better understand how to utilize the effective gross income formula, consider an example.

A four-unit property charges a monthly rent of $2,000 to each tenant, resulting in $8,000 of monthly rent in perfect circumstances.

The property includes laundry machines, vending machines, and parking spaces, which generate yearly profits of $3,500, $3,000, and $4,500, respectively. One unit has a dog, for which they pay a pet fee of $50 a month, or $600 per year. This other income provides $11,600 per year.

One of the units was vacant or non-productive for three months out of the year, resulting in a loss of $6,000.

The EGI would, therefore, be as follows:

Why Is EGI Important?

Understanding effective gross income helps you better identify a property’s income beyond just the monthly rent. In the real estate industry, investors calculate effective gross income in order to identify income producing properties and determine ways to boost their profits to compensate for the income lost by vacancy and credit losses.

The effective gross income formula is simple, and it goes hand in hand with determining the net operating income, as it encapsulates all the other services that create the overall profit. It’s also effective because it estimates real-world conditions for the property based on historical data, avoiding the pitfall of inflating net income.

Investors use effective gross income to calculate NOI, which is then used to identify the capitalization rate of real estate to see whether a property’s profit potential warrants the purchase price.

Key Takeaways

As a property owner, it’s important that you understand how to identify all of your profit so that you can better account for operating expenses and avoid losses.

The effective gross income gives you a holistic view of all your income streams, enabling you to get a good look at your potential income so that you can workshop ways to improve, such as investing in vending machines or charging tenants for extra storage space in a basement or secure outbuilding.

These are all low-cost ways to improve your profit margins, which will help you weather vacancies or non-payments from tenants.

When identifying your net operating income (NOI), you first calculate the effective gross income formula and then subtract your net operating expenses, such as taxes, insurance, and fees for a property manager.

If you have not yet ascertained vacancy and credit losses over several years of operation, it’s important to be realistic and rely on statistics from other investors in your area. You can also use official rental vacancy rates from the municipality, which generally include credit losses as well.

Effective gross income, in conjunction with net operating expenses, can identify the cap rate for a potential investment, ensuring that you’re not pouring money into an unprofitable venture.