*By providing your mobile phone number, you are certifying that you are the account holder for the mobile phone account or have the account holder's permission to use the mobile phone number in relation to this application and other related products and services that may be offered. You are also consenting to receive SMS text message notifications. Text message fees may apply depending on your mobile carrier plan.

You can text STOP to 512-788-9036 at any time to stop SMS text alerts that you activated. Emails sent to your primary email address won't be affected by this action.

With the Visio Broker Program, adding rental loans into your product offerings is easier than ever. The rental market is a $70 billion annual opportunity and growing. Residential brokers can use our Broker Program to keep their pipelines filled and commercial brokers never have to miss a loan opportunity. Visio Brokers can earn up to 5 pts per closed loan. Here are additional, compelling perks of brokering to Visio:

Repeat Business: Investors own multiple properties and offer counter-cyclical business opportunities

Less Regulations: Our rental loans are outside of Dodd-Frank and we do not require an NMLS license (except for in California and Arizona)

Less Work: Our in-house processing and Designated Account Executives keep your workload down

We are the Nation’s Leader in Rental Loans for a reason. When you send us business you can be sure your clients will have a superior lending experience. We have outstanding reviews, and have loan programs specifically designed to meet your investor clients’ needs. Here are just a few of the many reasons we are the best:

Customization: The Visio Lending Rental360 Loan Program is specifically designed for investors looking to grow their portfolios of single family (1-4 unit) rental and vacation rental properties. We have the most experience in the industry and have the customization investors need for their investment strategies. Rental360 investors can choose their rate structure, origination fee, and even prepayment penalty.

Direct Lender: While most lenders are reselling someone else’s loan product, Visio Lending is one of the very few direct lenders to rental investors. By cutting out the middlemen (yes, men!) you get a better loan product and smoother borrowing experience.

Highly Specialized in Rental Loans: We’ve closed over 11,000 rental loans. Visio Lending’s laser-like focus and rental loan expertise simply cannot be matched.

Cash Flow Based Lender: To determine if our borrowers qualify for our loans, Visio looks at the monthly cash flow generated by the property compared to the monthly expenses due. This means no DTI or personal income qualification AND no tax returns or 4506 requirements. We also do not have a limit on the number of mortgaged rental properties you can own, in order to enable professional investors to grow their rental portfolios.

Great Rates and Terms: Visio offers bank rates at private terms as well as full 30 year amortizing loans with no balloons. Our maximum LTV for cash-out refinances is 70% and our maximum LTV for purchases is 80%.

Portfolio and Vacation Rental Loan Programs: We make sense of the short-term rents and have a top-notch Vacation Rental Loan Program.

Our top rated Broker Program is designed to help brokers scale their business and build wealth with Visio Lending. We are proud to invest in our brokers with:

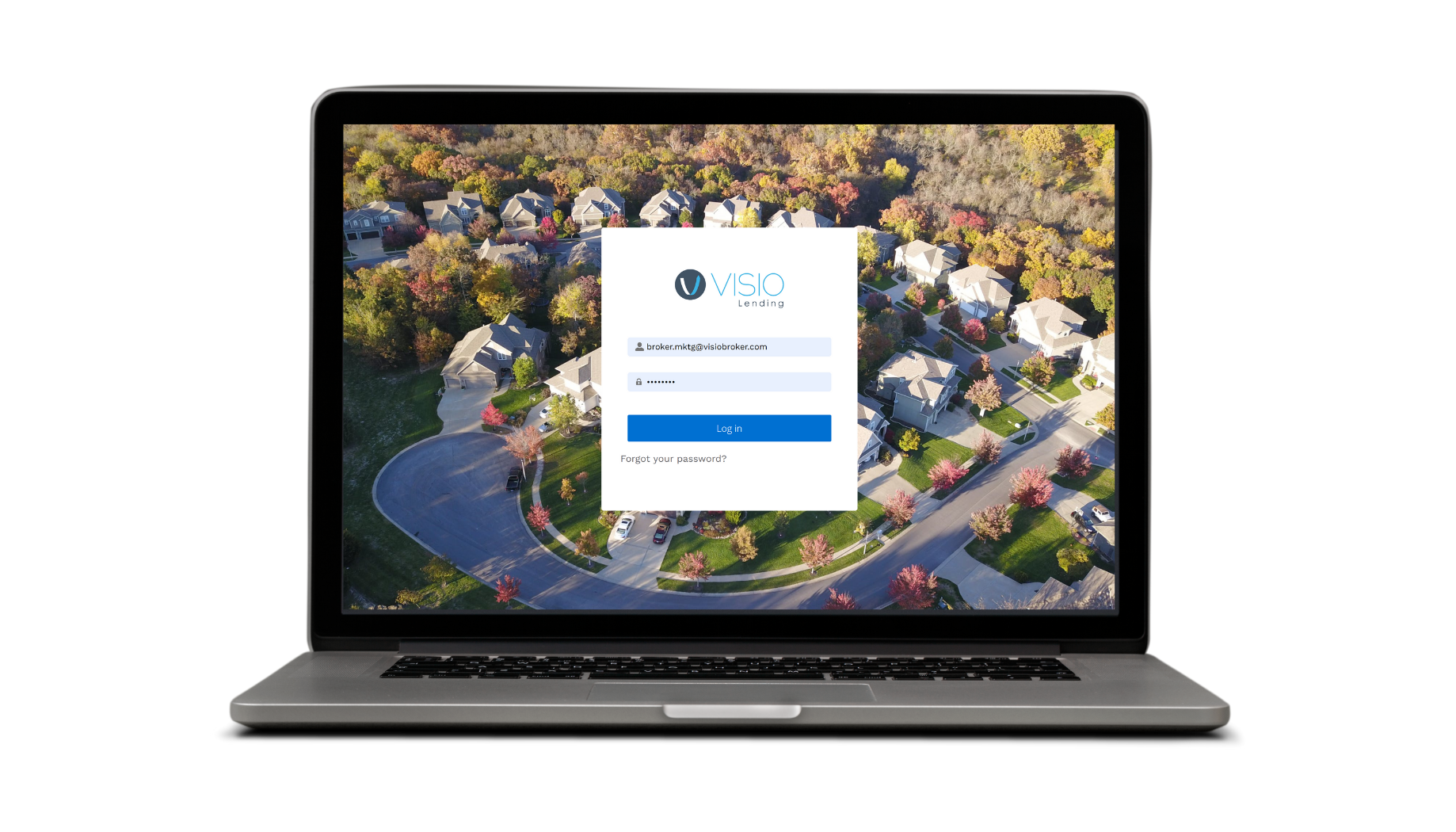

The innovative Visio Broker Portal enables brokers to access their loan information at any time, any place. Brokers can also:

See preliminary pricing for any deals as well as compensation from pending loans

Upload and manage your loan files

Access information from your past Visio loans to plan remarketing strategies

-1.png?width=1444&height=825&name=AE%20landing%20page%20bottom%20Carousel%20(4)-1.png)

Easily brand and put your contact information into our editable white label flyers. Download them here.

Visio Brokers earn up to 2 pts of YSP and 5 pts per closed loan. This amount can really add up, especially for active brokers. For more details, see our top broker payouts.

We want to make it as easy as possible for you to get started, so our broker Requirements are simple:

Visio Brokers must comply with all laws and regulations related to originating rental loans

Visio Brokers will only send us rental investors — no owner-occupiers

Visio Brokers must provide us with the necessary documentation and must fully and fairly describe the important terms to their clients

All documentation brokers submit must be true, complete, and accurate to the best of their ability

We will always provide you with our up-to-date rate sheets and white label materials. Additionally, we have a full library of Broker Resources that cover a variety of topics to help you succeed as a Visio Broker.

Check with your Account Executive for program availability and specifications

Visio Lending is the nation's premier lender for buy and hold investors offering, long-term loans for SFR rental properties, including vacation rentals.

All rights reserved. Copyright 2022. All loans are originated by Visio Financial Services Inc. or Investor Mortgage Finance LLC. Visio Financial Services Inc. is licensed by the California Department of Business Oversight as a California Finance Lender, license number 60DBO-56345 as well as by the Arizona Department of Financial Institutions as a Arizona Mortgage Banker, license number 1010600. Visio Financial Services Inc. company NMLS ID number is 1935590. Investor Mortgage Finance LLC is licensed by the Arizona Department of Financial Institutions as an Arizona Mortgage Banker, license number 1034031. Investor Mortgage Finance LLC’s company NMLS ID number is 2297729. For more information about the use of our Website, please see our Terms of Use and Privacy Policy.