There are many ways to invest in your future. You have the option to invest in shares that can pay out when a particular stock is performing well. Mutual funds are another source of investing that can help you secure significant gains as passive income. If you have enough savings, you can do something simple like switch to a high-yield savings account to make your money work a little harder.

There are many opportunities available to those who want to secure their financial independence by investing now.

The Power of Real Estate Investing

One of the most lucrative forms of investment is in the real estate sector. Real estate properties can produce a ton of upside for owners, whether they are interested in commercial or residential ownership.

Real estate investing is a tool that some of the richest individuals in the world have used to obtain their wealth, often in the millions or even billions of dollars.

Most people interested in real estate investing, however, are not trying to become the next billionaire. They are simply hoping to create passive income opportunities to make their lives more comfortable, both now and in the future. The reason why investing in real estate is so powerful is because of the reliability of monthly cash flow.

The three main ways that a real estate property can provide money include the ability to generate rental income, appreciation, and profits from business activities. Usually, a profit can be made on at least one of those circumstances for the investor.

There is one strategy in particular that many real estate investors fall in love with because of its potential profits and repeatability: The BRRR Method.

The BRRRR Method

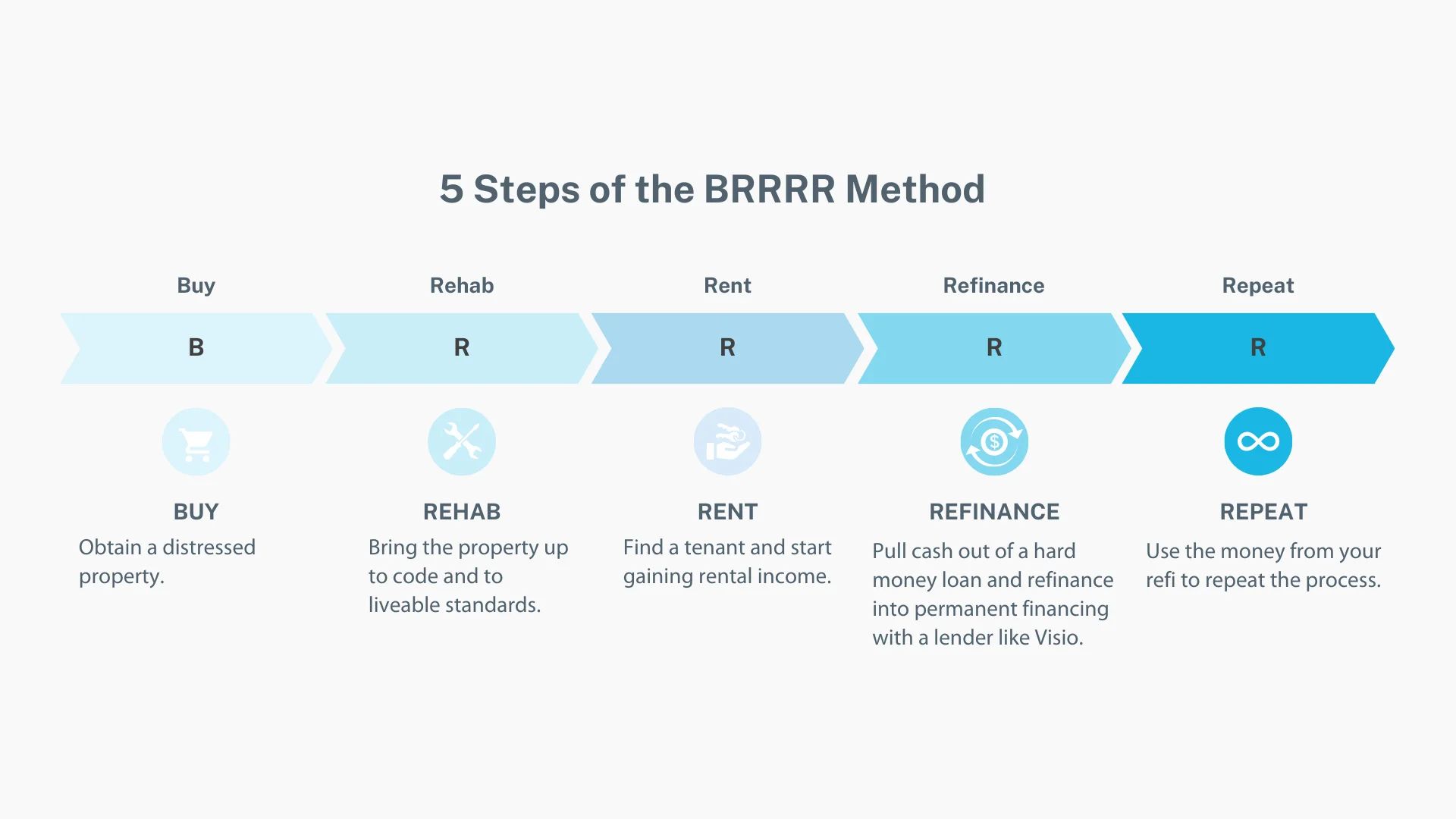

This real estate investing strategy is a unique one that can work well for the right investor. The BRRRR strategy is an acronym that stands for buy, rehab, rent, refinance, repeat. Essentially, this method follows the acronym. The investor buys a distressed property, rehabs it, rents it out, refinances to pull cash out, and then continues this pattern to build a portfolio and grow wealth.

A serious real estate investor can implement the BRRRR method rather effectively, but there are some significant barriers to entry and a lot of work involved.

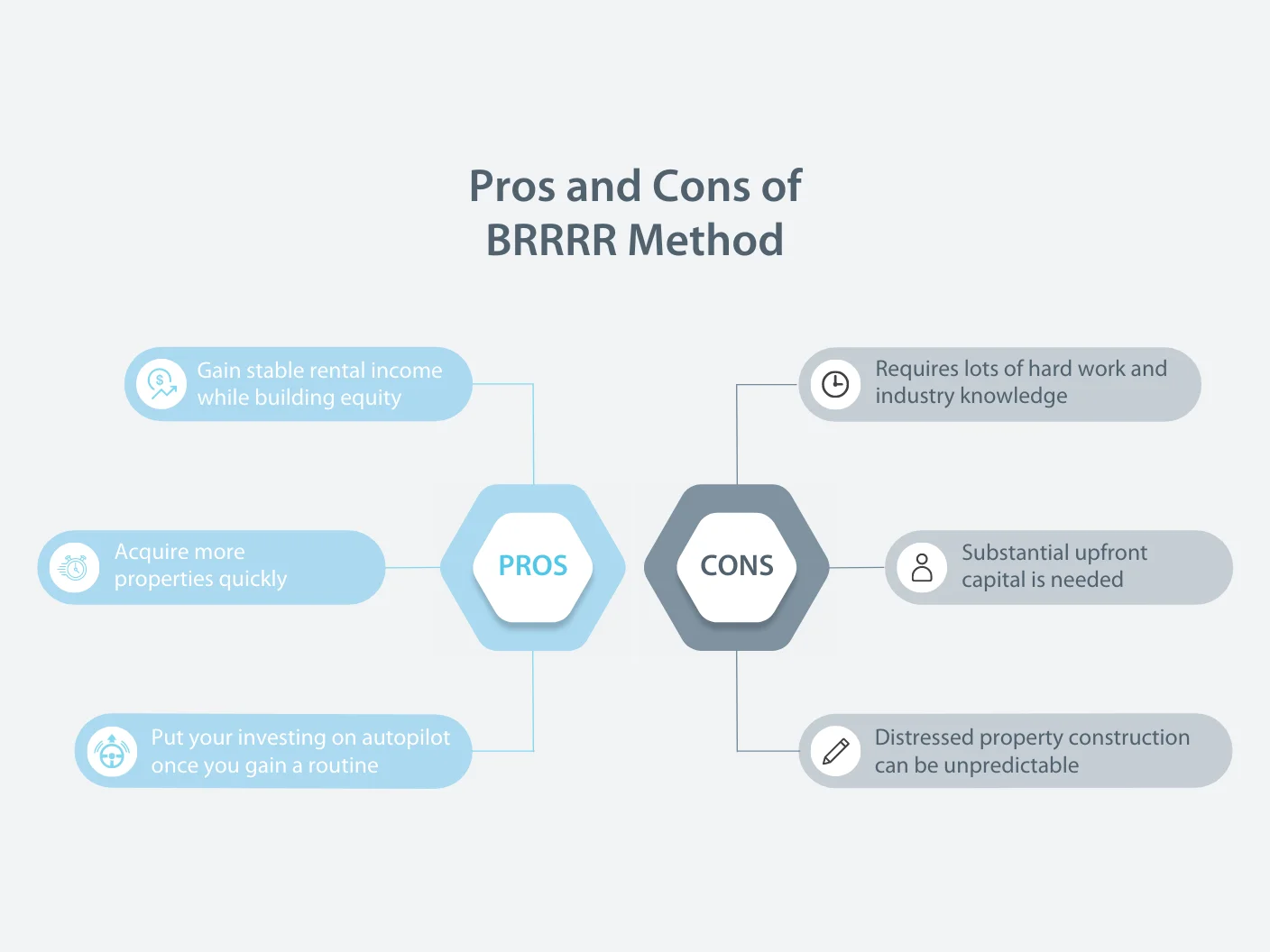

First, let’s take a look at some of the pros and cons of using this investment strategy.

Pro: Rental Income

The most obvious benefit of the BRRRR method is that it provides the investor with stable, passive income after a certain period. This is referring to the rental stage of the process. Rental properties generate rental income from the tenants that live there.

That money comes straight to you, which can be used to help pay off whatever loan or line of credit you may have used to buy the property in the first place.

Con: Upfront Capital Requirements

Securing a loan on a distressed property, which is a key aspect of the BRRRR method, is not always easy. Even if you do, you will need significant capital to invest in the property to bring it up to code and renovate the space so that it is appealing to potential tenants.

This requires a solid amount of cash to do well, depending on the planned upgrades and the local real estate market, and not everyone has a million dollars to jump into this game feet-first. It usually starts with a big chunk of your own money.

Pro: Repeatable

Growing your rental portfolio is a lot easier with the BRRRR method because it is very repeatable. The income you generate from rent will not only pay off your mortgage, but can also be used to fund the next property that you will purchase after a cash-out refinance.

This allows you to obtain multiple rental properties over time that can continue to generate more and more income.

Con: Lots of Hard Work

Rehabbing a property is not for the faint of heart. You have to put a lot of effort in when turning the distressed property into a liveable and appealing home for a tenant.

You will either need to pay for material and labor costs or do the work yourself, which can be arduous and time-consuming.

Pro: The Ball Keeps Rolling

If you can get your foot in the door successfully with the BRRRR method, you can eventually operate on autopilot.

Working with a local property manager can let you be hands-off once the property is being rented, putting money in your pocket as you build equity on the property.

Con: Difficult to Predict

When investing in a property that is in poor condition, there are a lot of numbers at play that you have to get right to make a profit. You’ll have to estimate the value of the property after the rehab, a number known as after-repair value (ARV).

Overestimating this number, or underestimating how much the repairs will cost, can result in fewer profits or a delay in building equity.

A Guide to the BRRRR Strategy

Hopefully, the pros and cons have given you some insight into whether or not you can take on the BRRRR method to improve your real estate investment outlook. As you can see, it is not for everyone and there are enough barriers to entry to deter many investors.

However, If this type of investing sounds like it would be perfect for your real estate portfolio, then you are going to want to read on. The five steps of this method can be incredibly complex on their own, and getting through each step successfully will require a lot of hard work and knowledge.

Let’s take a look at each step in greater detail to give you an accurate glimpse of what it takes to succeed with the BRRRR strategy.

Step 1: Buy

You cannot begin a real estate investing strategy without having a property to buy. You can purchase real estate property in multiple ways, but the key is that the property you are obtaining is distressed. This lowers the cost of the home, making it easier for you to skyrocket the value during the rehab phase and make money off of rental payments from the tenant.

Here are a few factors to understand within the buying phase.

Property’s After-Repair Value

The ARV is a very important number for real estate investors to understand when they are planning to renovate a property. To calculate the ARV, you have to compare the planned renovations for the property with similar properties in the area that were bought recently. Comparisons should be made based on square footage, number of bedrooms/bathrooms, amenities, condition, build type, and other relevant factors.

Overestimating the ARV could result in a longer timeframe for building equity or a cut into your profits. ARV represents the purchase price of the property plus the estimated added value of the repairs.

Maximum Allowable Offer

Another number to understand is the maximum allowable offer (MAO). This number helps you decide what to offer the seller so that you can turn a profit on the deal after making repairs. The simplest way to calculate the MAO is to follow the 70% rule. Multiply the ARV by .7. Then, subtract the cost of planned repairs. This new number is your MAO to start negotiations with the seller.

A few ways to convince the seller to accept this lower offer for their property is to waive contingencies, offer cash upfront either from your own capital or a hard money loan from private lenders, or offer to rent the property back to them.

Securing a Loan for the Investment Property

Conventional bank loans are difficult to acquire for properties in disrepair. Since lenders will want to determine the appraised value of the home, they may discover that the property does not meet their specifications for granting a conventional loan. For this reason, you may have to turn to other sources to finance the purchase.

You could obtain a hard money loan from a private lender which uses the property itself as collateral, consider a home line of credit, or cover the purchase price on your own. Investors with less money to start may have to look to hard money lenders to get started on their BRRRR properties. Keep in mind, though, these loans often require a larger down payment.

Step 2: Rehab

The rehab phase of the BRRRR method may be the most complicated step. Since you are investing in distressed properties, there is a lot of work to be done before you can make any kind of income from tenants and refinancing. If you do not have a solid plan for bringing a distressed property up to liveable standards, then purchasing an investment property could end up being a waste of time and money.

There are a few factors to consider.

Determining a budget

Between buying the property for a number below the MAO and the costs of a potential loan and repairs, you will be spending a lot of capital on this venture. To ensure that you do not overspend, a budget must be determined ahead of time to keep you on track. Be realistic with what you can afford for a mortgage payment if you secure a loan of some kind on top of the repair costs.

Make sure the ARV you have calculated is accurate based on the planned renovations.

Calculating Costs

This phase requires a lot of intensive research. A thorough look at the property itself will give you a vision of the specific repairs and upgrades that are needed. From there, get as many quotes as possible for the renovation costs so that you can use the total to calculate the MAO. Underestimating rehab costs can put you in a tough position financially if you are not careful.

Knowing What Repairs to Make

Another complex factor in the rehab process is knowing what to do in the first place. The top priority is making sure that everything is up to code so that tenants could safely move in. Then, you want to focus on amenities to make the space more appealing. Third, you can boost curb appeal with aesthetic changes to the building’s exterior and the plot of land that it sits on to entice tenants.

The more property value you add with rehab projects, the more profit you can make if you choose to sell down the road after renting it out for a while, though this undermines the BRRRR method.

Step 3: Rent

You have poured money into investing in a rental property and acquiring it. Then, you spent even more money on making repairs, either doing the work yourself or paying for contractors to assist you.

The distressed property is now a beautiful home that is just waiting to start generating passive income. It’s time to start renting the rehabbed home to tenants.

Finding Tenants for the Rental Property

Now that you own the rental property and it is fit for tenants, you have to find someone who will pay a monthly rent to occupy the home. You want to make sure that this tenant is reliable so that they can cover their expenses, which in turn will cover yours. Create a thorough application and be ready to conduct a credit check and background check on them. The better their credit report, the more reliable they are when it comes to making payments. You must, of course, have their consent to run a credit report.

Another option is to hire a property management company that can handle tenant acquisition for you if you have the funds to do so, lightening your workload. Often, property managers are paid through taking a percentage of rent payments.

Calculating Rent

A fair rent to charge your tenants must be chosen. First, browse single-family rental properties in your local market to figure out a number that will entice potential tenants while still providing you with substantial cash flow. Tools like Rentometer can help you determine a fair amount.

Make sure that your monthly mortgage payment or loan payment is more than covered by this income. The longer you own the property and collect rent payments, the more equity you will build on the property.

The money that goes into your pocket could even be used to pay down the principal to accomplish this quicker, or saved to fund your next BRRRR properties.

Step 4: Refinance

This next step is the one that differentiates the BRRRR method from many other investment strategies like house-flipping or simply collecting rent until you can afford the next property. Refinancing is an option if you have taken out an investment property loan of some kind to pay for the property upfront. As you collect rent from the tenant and make your monthly payments, you are building equity in the property and reducing the principal loan amount.

Cash-Out Refinance

Typically, cash-out refinancing is the tool used for this real estate investment strategy. Essentially, you apply for a loan that is larger than the amount that you currently owe on the principal balance of the previous loan. Then the difference between the new loan and the owed principal of the previous one is given to you as cash.

For the BRRRR method to continue, you would then use that cash as a down payment for another rental property that you are looking at.

You can also use cash reserves from rental income for that same down payment. Alternatively, you can work with an investor DSCR lender like Visio and use the rental income to prove your ability to pay off the loan.

Refinance Requirements

One of the factors to be aware of is the cash-out refinance requirements of your chosen lender. First, you need to find an entity that offers a cash-out refi as a loan product. Then, you need to make sure that you have a good credit score and a low debt-to-income ratio. If you are working with an investor DSCR lender, you need to have high enough rent payments to cover the monthly mortgage payments. You will additionally have to be able to cover the fees associated with the loan.

It is also critical to know what the requirements are for a cash-out refinance on the property. There could be minimum limits for the length of the current tenant’s stay or how long you must own the property.

Before you accept a loan from the lender in the first place, find out what these requirements are for a future cash-out refinance.

Step 5: Repeat

The final step in the process, and what makes the BRRRR method truly unique, is to repeat everything from start to finish. You now have a lump sum of cash that you have generated from refinancing the rehabbed property, as well as money from positive cash flow, to spend on a new property.

Your initial property purchase becomes an automatic generator of income once you have filled it with tenants and refinanced, so you can repeat the process to turn more distressed homes into turnkey properties.

With each new property that you buy, rehab, rent, refinance, and repeat, your net operating income increases as you collect rent from more and more properties every month. You also will be building equity in each property.

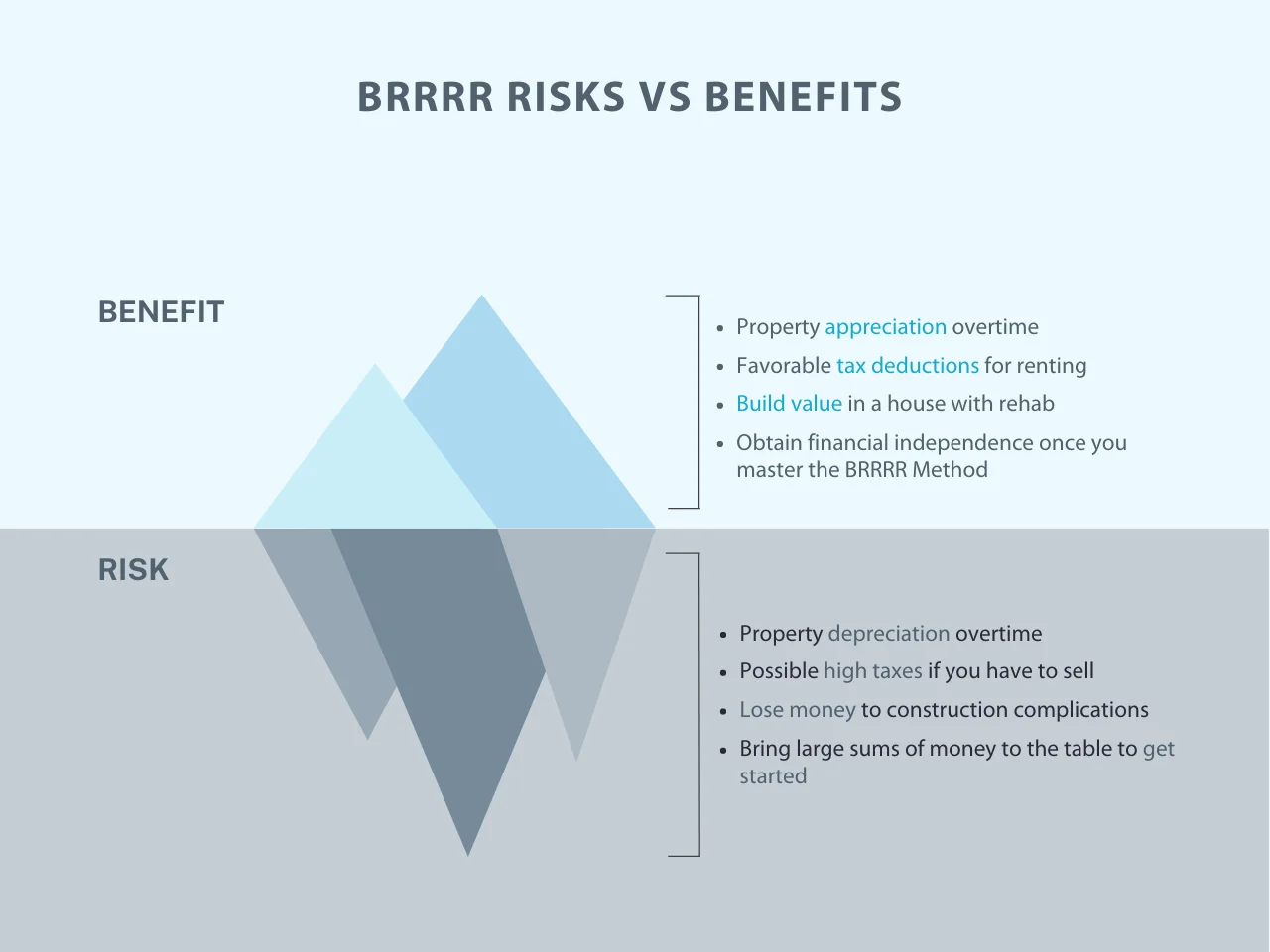

Risks and Benefits to Consider with the BRRRR Method

Hopefully, you have a bit of a firm grasp on the BRRRR strategy for real estate investing. While the steps themselves may seem simple enough to understand, they can be vastly more complicated than you might expect in practice. If you are not prepared with the right knowledge and resources to enact the BRRRR method effectively, then you could end up tying down your assets in a frustrating investment that takes longer than expected to pay off.

Let’s break down some of the other factors that come into play if you are interested in the concept of buy-rehab-rent-refinance-repeat.

Property Values

The passive income that you receive as a real estate investor with this strategy is not the only way that money can be generated from the property. Based on the property value, you could be in a positive or negative position throughout this process.

If the appraisal does not go favorably, either when you buy low at the beginning or refinance after holding for a couple of years, then you could make less money than expected or you may not be able to finance the property ASAP.

Alternatively, if natural appreciation occurs and the appraisal determines the value to be higher than you predicted, then there could be more money in it for you.

The Cost of Loans and Refinancing

Conventional loans for home buyers are flexible with the requirements. Between mortgage insurance, down payments, interest rates, government-insured options, and loan term agreements, lenders can mitigate the risk to themselves of loaning money to borrowers. Hard money loans and refinances tend to be more expensive for the borrower to acquire. They often require a much higher initial down payment, interest rate, and credit score to obtain. There will also be significant closing costs and fees associated with the loan agreement.

Since a loan on a soon-to-be-rehabbed property is considered risky, lenders want to make sure that they are making enough money on the transaction to protect their interests. This is why the BRRRR method often requires a large initial investment from the borrower, so getting into the game is only possible for those with a fair amount of capital available at the beginning.

Tax Benefits

Selling a property is a taxable event. If you like to flip houses and generate profit from the equity and value increase, then you will still be taxed on the total amount of the sale. When you refinance while following the BRRRR method after rehabbing and renting the property, you will not be taxed for this transaction.

For this reason, the BRRRR method is favorable to some investors over flipping houses because you can avoid heavy taxation while still benefiting from the value of the property once you refinance.

Rehabbing Correctly

The success of the BRRRR strategy is based on the effectiveness of the repairs that you make. If you are not certified or skilled enough to ensure that the home is up to code, then you will have to rely on managing contractors to get the job done. While DIY renovations are growing in popularity, and learning the skills to tackle various projects is more accessible than ever, upgrading a distressed home is a tall task for anyone to attempt without help.

Make sure that the contractors you work with have the requisite experience to rehab the property correctly. Otherwise, you may end up spending more money than you wanted to in the rehab phase. Conversely, the right professionals can increase your chances of higher cash flow and quick tenant acquisition by perfecting every upgrade.

Financial Independence

The most significant benefit of the BRRRR method is the ability to secure your financial future. The more investment properties you acquire and rent out to tenants, the more cash flow you have coming in. In many cases, refinancing can happen after just two years, so you have time to make the repairs and upgrades and also time for the tenants to occupy the home for half a year or more.

While the BRRRR strategy typically does not allow you to take out local bank loans that are more conventional, the money you earn from the properties can more than offset the difference between the higher down payment, closing costs, and interest rates. There are also private lenders like Visio designed to help real estate investors thrive. With us, you can refinance your hard money loans from the renovations into permanent financing.

Is the BRRRR Method Right for You?

If you are looking for a way to get into the lucrative world of real estate investing, and you have some capital to spare, then perhaps you should consider if this strategy can work for your financial goals. Start by conducting research into the various steps of the process.

Learn about cash-out refinancing options, including loan-to-value ratio minimums.

Check out the real estate market in which you plan to invest to see what homes are being sold for so you can start to think about appropriate upgrades, the ARV, and the MAO.

Research local contractors that are reliable and have plenty of experience upgrading residential properties with a wide array of services.

Take a hard look at your current assets and see what you could afford in terms of monthly costs, a repair budget, and time spent on the project. Can you afford to tackle this venture and spend time upgrading before earning any income from tenants? Always be as accurate as possible with your budget, even estimating within a few hundred dollars of your goals.

Once you have put in the time to plan, research, and prepare for your real estate investing strategy, it is time to initiate the BRRRR strategy.

While there are many examples of people generating enormous profits as a result of this concept, there are plenty of others who struggled to achieve their goals. The more prepared and knowledgeable you are about what it takes, the better chance you will have of turning it into a passive income-generating investment portfolio.

Hopefully, this guide can serve as a starting line in the race toward your real estate investment goals.