Commercial real estate lenders use a variety of metrics in order to identify whether a given loan presents an acceptable level of risk. One of these is the debt yield formula, which balances the property’s net operating income with the requested loan amount. The debt yield ratio is part of how commercial real estate loans are approved.

Talk to an Investment Property Expert

What is debt yield?

Debt yield is the return that a lender would receive if the borrower defaulted on the loan and the lender had to foreclose on the subject property. This is a simple metric used to determine the risk of a proposed loan. It’s also used to ensure a loan amount isn’t inflated by low market cap rates, low interest rates, or high amortization periods, which can all skew other analysis metrics such as loan-to-value ratio (LTV).

How to Calculate Debt Yield

The formula for debt yield is: Debt Yield = Net Operating Income (NOI) / Loan Amount

Debt yield is calculated independently of capitalization rates (cap rate), interest rates, or amortization. The higher the debt yield, the lower the risk for the lender — in other words, the lender would get a higher return in the case of immediate foreclosure.

An important part of debt yield is the strength of your net operating income (NOI). NOI helps lenders forecast the profitability of the property and assess its initial value, and they often consider it even more important than the investor’s credit history.

Calculating NOI

You can calculate NOI using this formula:

Net Operating Income (NOI) = Real Estate Revenue − Operating Expenses

The total revenue includes not only rental income but also revenue from laundry machines, parking permits, and any other income from the property. Operating expenses include repairs, maintenance, taxes, insurance, utilities, and all other expenses except for mortgage payments.

Other Factors That Influence Debt Yield

Other factors that influence the debt yield calculation include:

- Property type – Certain types of commercial property have higher expenses than others, like hotels versus office buildings. This impacts net operating income and, therefore, debt yield.

- Total loan amount – If you take out the maximum loan amount, your debt yield will be lower, which indicates a higher risk.

- Current market value – The property value also matters, as this impacts the loan amount. Lenders typically don’t want to finance properties with a very high purchase price because they have a higher credit risk. There is typically a market value range that lenders prefer to work in.

Now that you know how to calculate NOI and debt yield, you can look at other important elements of risk assessment and how they relate to debt yield.

What does debt yield tell you?

Debt yields are, in essence, a risk assessment calculation. Unlike the debt service coverage ratio or LTV ratio, debt yield is mostly static, so it won’t be greatly influenced by huge leaps in property values or extreme interest rates; this makes it a more accurate measure of real estate risk than other methods.

Recoup Time

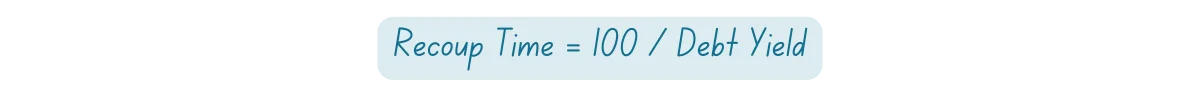

Knowing a loan’s debt yield also helps lenders determine how long it will take for them to recoup their investment. The formula for recoup time is simple: Recoup Time = 100 / Debt Yield

If we assume a debt yield of 10%, it would take the lender ten years to recoup a potential loss.

Maximum Loan Amount

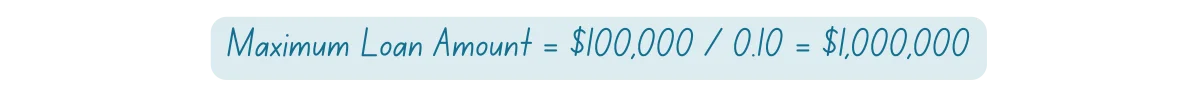

If you want to do some calculations on your own before going to the lender, and you know the expected NOI, their accepted debt yield can also give you the maximum loan amount.

Maximum Loan Amount = Net Operating Income / Debt Yield

For example, if the net operating income is $100,000, and the debt yield is 10%, the calculation looks like this:

Maximum Loan Amount = $100,000 / 0.10 = $1,000,000

Of course, lenders use other metrics, including LTV and DSCR, to calculate the maximum loan amount. When they use all three, they choose the ratio that gives them the lowest maximum amount.

What is an acceptable debt yield?

Most lenders will accept a minimum debt yield of 10%, but debt yield requirements vary among lenders; some may accept a lower debt yield, sometimes as low as 8%.

The higher the debt yield, the less risky your commercial real estate loan will be, as higher debt yields mean that the commercial lender will recoup more of the loan in the case of default or foreclosure.

A very good debt yield could be anywhere from 12% to 18% on commercial and multi-family loans, and more lenders will be willing to work with you.

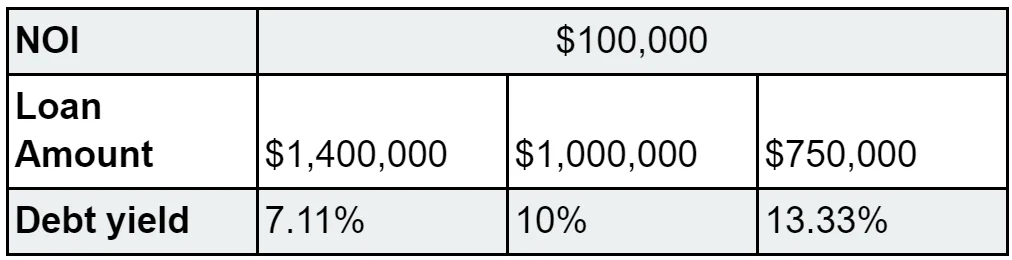

Here’s what a debt yield calculation looks like with the same NOI of $100,000 but varying loan amounts:

- The first debt yield ratio shows that the borrower would be rejected in almost every loan scenario.

- The second is a good debt yield that would have a chance with most lenders.

- The third example illustrates an excellent debt-yield ratio.

Other Important Loan Analysis Criteria

Commercial lenders rely heavily on debt yield, as it is a more objective measure of the risk posed by a loan than other calculations, but they also take in numerous factors beyond the debt yield calculator.

Debt Yield vs. Cap Rate

Cap rate focuses on a property’s return on investment by dividing the property’s net operating income (NOI) by property value, then multiplying by 100. It’s primarily used by investors themselves rather than commercial real estate lending companies, though many lenders may calculate it as well.

Debt Yield vs. LTV

The loan-to-value ratio (LTV) shows how much of the market value the lender is willing to finance and how much is on the borrower to cover with a down payment or, in the case of refinancing, equity. For example, the highest available LTV for investment properties is 80%.The loan-to-value ratio is inversely proportional to debt yield. Let’s say you want to purchase a $1,000,000 rental. As you increase your down payment, your LTV drops, and the debt yield rises.

Debt Yield vs. DSCR

The debt-service coverage ratio forms the basis of a high-performing DSCR loan, but it’s also utilized in the approval process for other loans. DSCR identifies how well the property finances its annual debt payment. It’s calculated by taking the net operating income (NOI) and dividing it by the annual debt service to create a ratio. Ratios above 1 indicate the property fulfills its debt obligations and is generating positive cash flow.

While it’s similar to the debt yield formula, DSCR analyzes profitability by calculating annual income, which will change over time with amortization. While typically only lenders calculate debt yield, both investors and lenders will focus on DSCR. (Use our DSCR Calculator to determine your DSCR.)

Debt Yield Calculation with DSCR and LTV

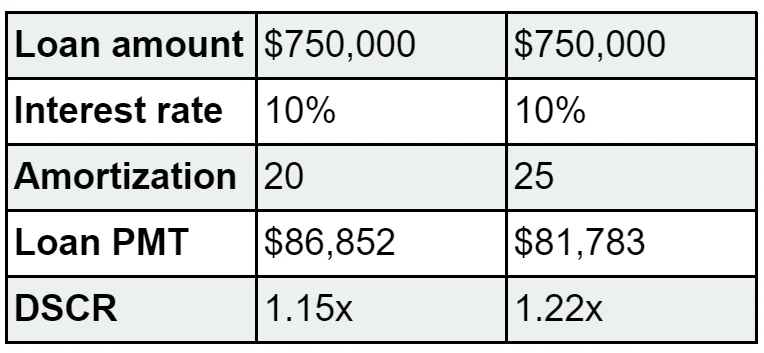

A requested loan must be supported by debt yield and comply with LTV and DSCR requirements as determined by the lender.

For example, DSCR can be adjusted to fit a lender’s “box” by changing the amortization period. In the table below, expanding the amortization period by five (5) years from 20 years to 25 years increases the DSCR from 1.15x to 1.22x. If the lender had a 1.20x DSCR requirement, that one small adjustment can make the difference in getting a loan done or not.

The adjustment to the amortization period does not impact the debt yield. In the example (assuming NOI of $100,000, a 10% cap rate, and 75% LTV) above, the debt yield would be calculated as follows:

Debt Yield = Net Operating Income (NOI) / Loan Amount

Debt Yield = $100,000 / $750,000

Debt Yield = 13.33%

Why Lenders Use Debt Yield

Debt yield provides a lender a measure of risk independent of interest rate and amortization periods, which DSCR and LTV don’t allow for. Given the recent real estate market conditions (pre-COVID-19), where low interest rates and compressed cap rates were the norm, loan amounts determined solely by DSCR and LTV provided little comfort in a rising interest rate environment. Net operating income tends to stay relatively stable, and the total loan amount is a fixed cost, which creates a more consistent metric.

Secure a Fast, Simple, and Dependable Investor Loan From Visio Lending

The Visio team has decades of experience helping real estate investors successfully grow their rental portfolios without difficulties and delays. We offer flexible loan terms, a convenient LTV ratio, and competitive interest rates on our real estate investor financing.

Contact us today to see how we can help you boost your annual income through high-performing DSCR loans.

Related: Guide to Visio’s Residential Rental Loans,5 Key Small Balance Commercial Loan Types