Non-QM has become a new buzzword. It seems all the lenders these days are offering hip new Non-QM loan products and encouraging brokers to broker non-QM loans. Borrowers are also being persuaded to take out non-QM loans. So, what actually is a non-QM loan? A good place to start is in defining QM or Qualified Mortgage.

The concept of a Qualified Mortgage originated as a result of the 2008 financial housing crisis and the subprime mortgage crisis. Leading up to the financial crisis, there were all kinds of innovative loan products with creative rate structures on the market that ultimately borrowers couldn’t pay back. To reign in lenders and ensure that borrowers can afford the loans they are receiving, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act that put into place the QM rule. It is a complicated rule, but ultimately QM loan originators must comply with stringent rules to make sure the consumer mortgage borrower can repay their loan.

Regulated by the Consumer Financial Protection Bureau (CFPB), QM loans have restrictions on risky features, limits on the price of your loan, and ceilings on the upfront points and fees lenders can charge, among many other regulations.

In the aftermath of the QM rule, any loans outside of the Consumer Financial Protection Bureau's guidelines were considered non-QM. Let's take a closer look.

The Rise of Non-QM

The technical requirements of a qualified mortgage exclude many creditworthy Americans with a strong ability to repay their loans. For instance, what happens when the self-employed contractor with multi-millions doesn’t qualify for a qualified mortgage because he doesn’t have the documentation needed? The guy with the ten-million-dollar net worth and perfect credit should be an ideal borrower, right? In the last three years, lenders and the capital markets have started to serve these people and fill the gaps. Capital markets have gotten increasingly comfortable with non-QM mortgages, and lenders have gotten increasingly better at putting reasonable processes into place to determine the borrower’s ability to repay.

QM vs Non-QM Loans

Both qualified mortgages and non-qualified mortgages can be divided into two categories: consumer purpose loans and business purpose loans. Most loans backed by the federal government are consumer loans, but there are some investment property QM loans. Similarly, most non-QM loans are for investors, but there are some exceptions for owner occupiers. Some of this key criteria includes limiting risky features such as allowing for interest only payments, negative amortization, extended loan terms. or balloon payments. There are also stringent requirements on income and credit history verification.

To get a clearer picture, let's take a look at the different kinds of QM loans and non-QM loans

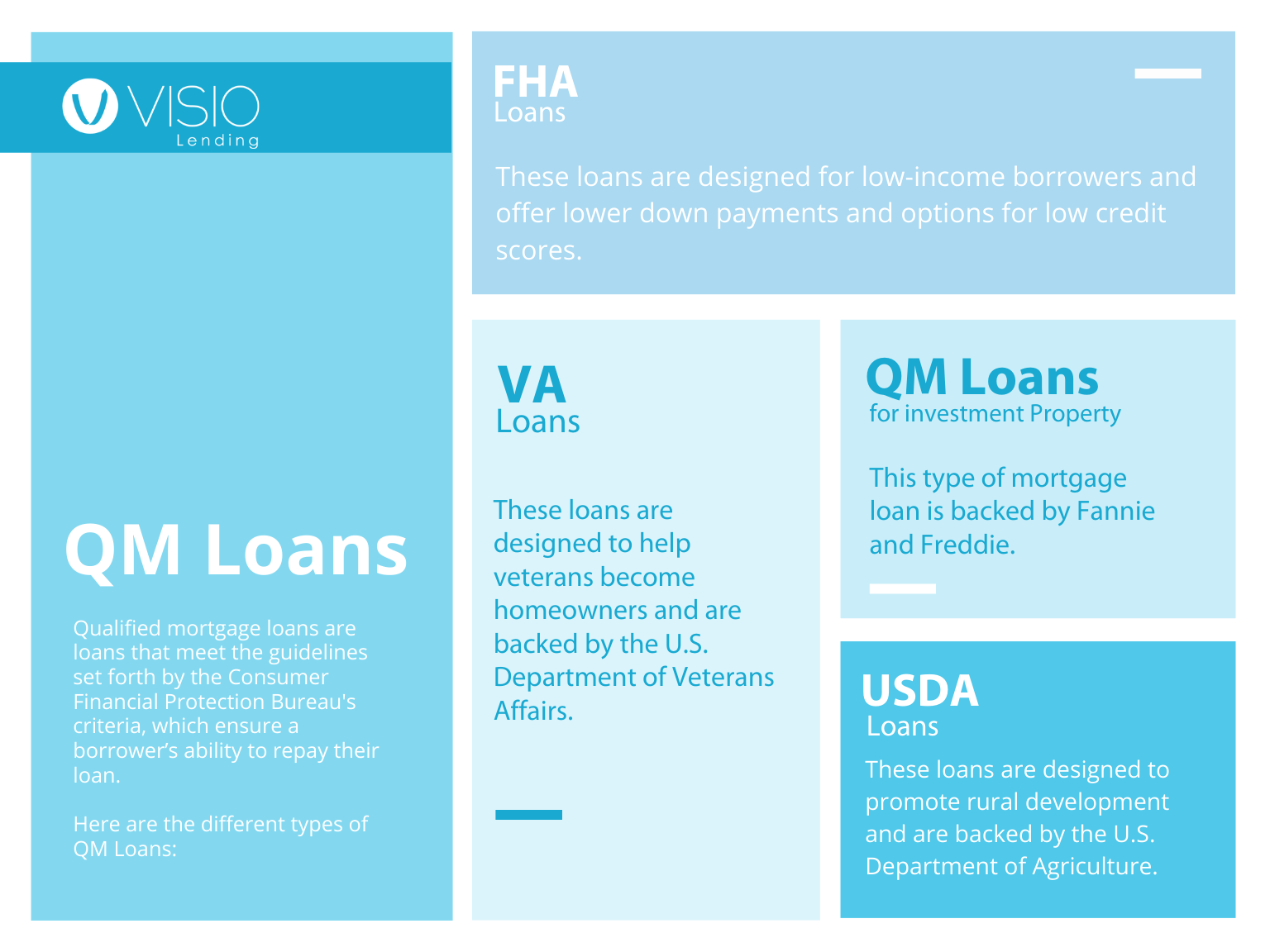

Types of QM Loans

As we previously stated, qualified mortgage loans are loans that meet the guidelines set forth by the Consumer Financial Protection Bureau's criteria, which ensure a borrower’s ability to repay their loan.. There are many buckets of QA loans including FHA Loans, VA Loans, and conventional loans for investment properties.

FHA Loans

These loans are designed for low-income borrowers and offer lower down payments and options for low credit scores.

VA Loans

These loans are designed to help veterans become homeowners and are backed by the U.S. Department of Veterans Affairs.

QM Loans for Investment Properties

This type of mortgage loan is backed by Fannie and Freddie.

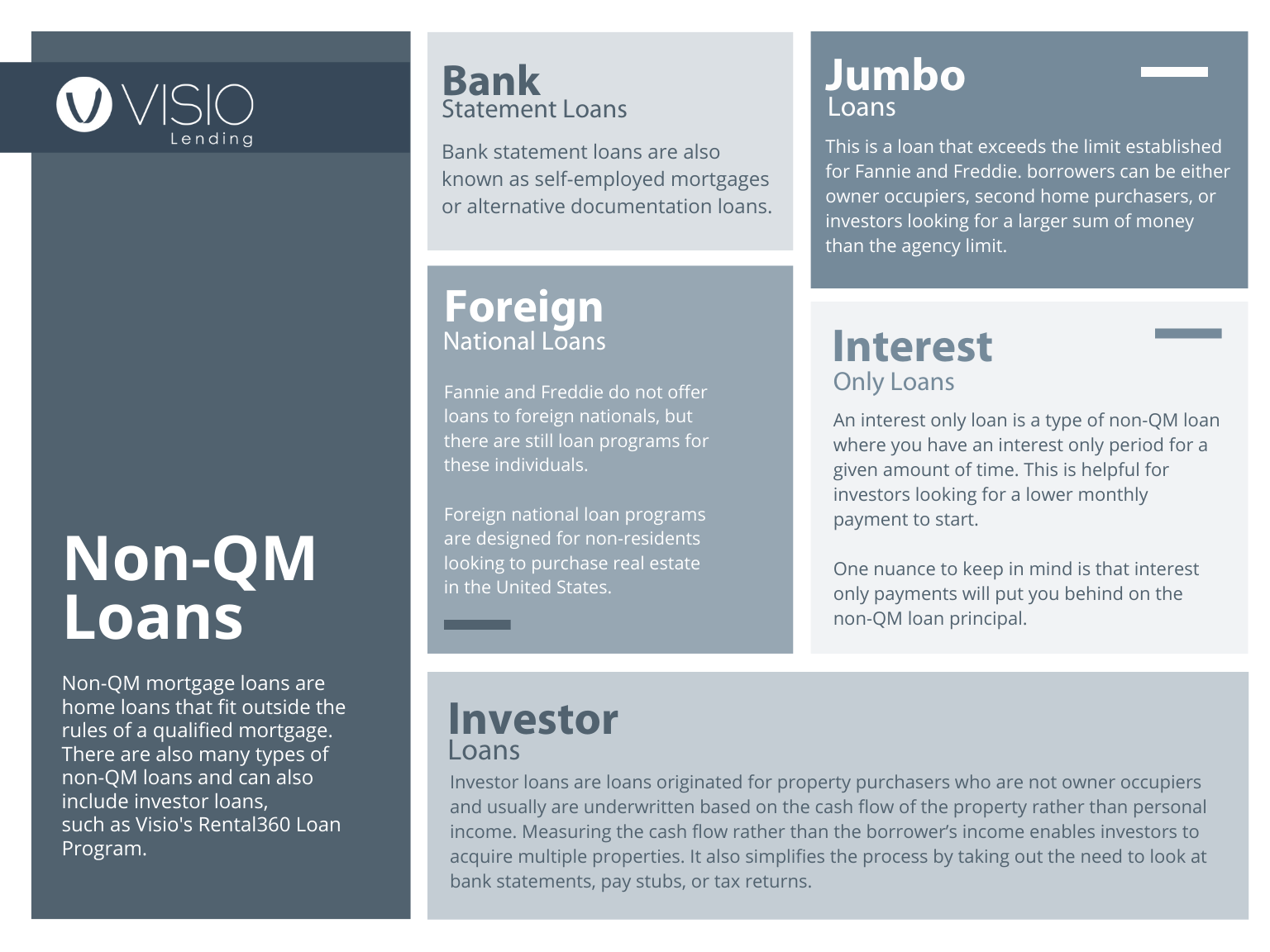

Types of Non-QM Loans

Non-QM mortgage loans, on the other hand, are home loans that fit outside the rules of a qualified mortgage. There are also many types of non-QM loans, such as jumbo loans, bank statement loans, foreign national loans, and more. It can also include investor loans, such as Visio's Rental360 Loan Program.

Jumbo Loans

A jumbo loan is a loan that exceeds the limit established for Fannie and Freddie, which is $548,250 for 2021. Jumbo loan borrowers can be either owner occupiers, second home purchasers, or investors looking for a larger sum of money than the agency limit.

Bank Statement Loans

Bank statement loans are also known as self-employed mortgages or alternative documentation loans. To qualify for one, a borrower can use their personal and/or bank accounts to prove their income rather than W2s and tax returns. In other words, bank statement loan lenders look carefully at a number of borrower bank statements. These loans are ideal for self-employed borrowers or contractors who do not meet agency requirements based on tax returns.

Foreign National Loans

Fannie and Freddie do not offer loans to foreign nationals, but there are still loan programs for these individuals. Foreign national loan programs are designed for non-residents looking to purchase real estate in the United States.

Interest Only Loans

An interest only loan is a type of non-QM loan where you have an interest only period for a given amount of time. This is helpful for investors looking for a lower monthly payment to start. One nuance to keep in mind is that interest only payments will put you behind on the non-QM loan principal.

Investor Loans

Investor loans are loans originated for property purchasers who are not owner occupiers and usually are underwritten based on the cash flow of the property rather than personal income. Measuring the cash flow rather than the borrower’s income enables investors to acquire multiple properties. It also simplifies the process by taking out the need to look at bank statements, pay stubs, or tax returns.

Non-QM Loans vs. Conventional Loans

A conventional loan is a home loan that is not backed by the government. Like a conventional loan, a non-qualified mortgage is also one not backed by the government. However, conventional loans typically meet the guidelines of Fannie and Freddie, which are government sponsored entities.

QM vs Non-QM Investment Loans

When it comes to financing an investment property, qualified mortgages are the most affordable option with the lowest interest rates, yet they have strict guidelines in place. Investors just getting started, particularly those with high income, are drawn to QM loans. Newer investors are often able to document their income and meet the strict criteria set forth by Fannie Mae and Freddie Mac.

On the other hand, non-qualified mortgage investment loans meet the needs of professional investors with portfolios of rental properties. Non-QM loans are much easier to qualify for, despite the larger expense. Not to mention, professional real estate investors are focused on building wealth over time and growing their monthly cash flow. In the big picture, the slightly higher investment property mortgage rates are outweighed by the significantly greater flexibility they have to achieve their larger investment goals.

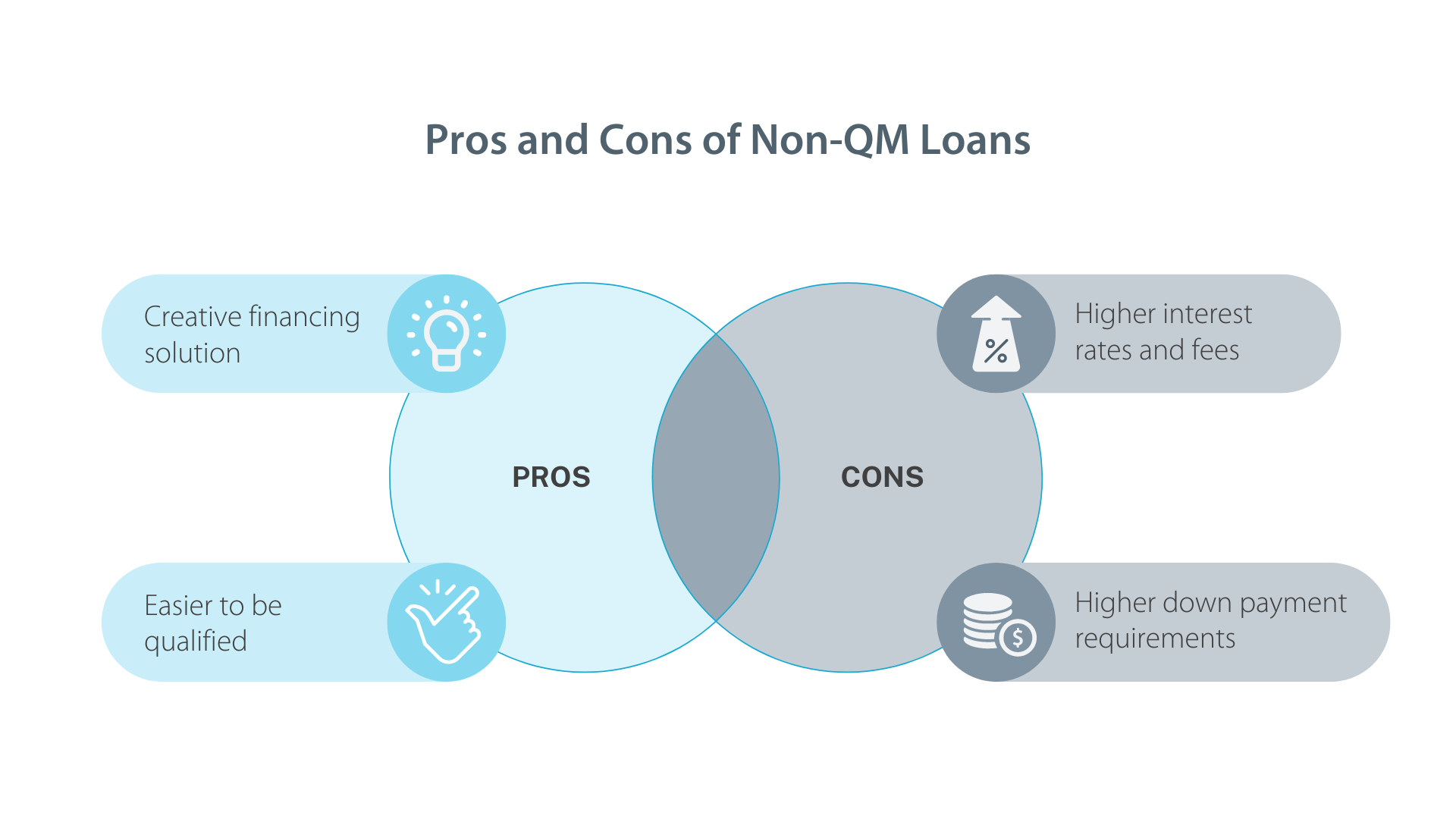

Pros and Cons of Non-QM Loans

Non-QM loans can be a creative financing solution for unique situations such as financing for foreign nationals or self employed individuals. They are also much easier to qualify for than QM loans and do not require income documentation. However, there are some drawbacks to consider. Interest rates and fees are higher than those of a standard QM loan. They also typically require higher down payments and can have some associated risks. In the next section, we'll take a closer look at why investors are one of the largest user groups of non-QM loans.

Why Non-QM Loans Appeal to Investors

While it is possible to obtain agency financing for investment properties, as we previously mentioned, the underwriting guidelines can be restrictive.

Non-QM Investor Loans are Underwritten Based on Property Cash Flow

An experienced investor with multiple mortgaged investment properties and self-employed professionals without W2s often have difficulty meeting the personal income requirements set by Fannie Mae or Freddie Mac. Non-QM investor loans also have lower documentation requirements than traditional qualified mortgages.

Non-QM Loans Allow Investors to Borrow in an LLC

Many experienced investors prefer to borrow through an LLC or corporation to protect their identity and other investments. Fannie Mae or Freddie Mac loans can only be obtained in an individual(s) name.

Non-QM Loans Enable Investors to Quickly Grow their Portfolio of Rentals

Even if you have enough personal income to support multiple mortgages, with federal government sponsored loans, you are maxed out at 10 loans. Non-QM lenders do not have a limit offering investors the opportunity to grow their portfolios before other investments are fully paid off.

What Should You Look for in a Non-QM Investor Loan?

There are many non-QM investment mortgage lenders on the market and determining which one is the best for you can be overwhelming. We always recommend consulting your counsel for personal guidance, but here are some questions to take into consideration.

What are the lender’s interest rates and fees?

While this may sound like a given, it is important to know exactly what your costs will be for the loan. The last thing you want is to end up at the closing table with unexpected costs. Make sure you have a clear picture of any underwriting fees, legal fees, and any possible factors that could adjust your rate.

What are the lender’s eligible property types?

Different non-QM lenders allow for different properties. For example, some non-QM lenders do not allow non-warrantable condos, boarding houses, or multi-family homes. Lenders also have different requirements and programs for property condition.

Is the lender investor-friendly?

Lenders who work with investors regularly typically have the optionality to meet your investment strategy. For instance, Visio has prepayment penalty and rate buy-downs as well as a selection of rate structures including interest only loans, to provide investors the flexibility they need.

Secure a Non-QM Loan from Visio Lending

Visio is a leading provider of non-QM mortgage products. Our Rental360 is underwritten based on rental income and borrower credit history, rather than the borrower’s personal income. As a result, the Rental360 is an ideal financing product for the self-employed investor or the investor that is building a portfolio of properties.