Working with Visio Lending means having a dedicated platform to manage your DSCR loan from start to finish. To support our partnership with brokers, we have created the Broker Portal, a secure system that consolidates the tools you need in one place to organize, price and submit deals efficiently. All brokers have access to their own portal, which serves as the hub for everything Visio.

This guide walks you through the ins and outs of the Visio Broker Portal, with clear steps to help you get started and navigate the platform. We’ll also cover how to use the portal to communicate with your Visio team throughout the loan process.

What is the Visio Lending Broker Portal?

The Broker Portal was designed to simplify and streamline the loan process. More than just a submission tool, it serves as your personal dashboard, offering complete access to your pipeline and direct support from your Visio team.

Within the portal, you can input new deals, acquire preliminary pricing, track files in real time and communicate with your account executive and processor.

Step-by-Step Instructions for the Visio Portal

Because the portal is your central hub for interacting with Visio, it’s essential to understand how the platform works. Below is a detailed breakdown of how to navigate the Visio Portal and make the most of its features.

Step one: How to get access and set up your account

Getting started with the Broker Portal is straightforward and only takes a few minutes. Once your account is approved, you’ll receive a welcome email with everything you need to set up your profile and access the platform.

As part of the setup, you’ll create a secure password to protect your account. Your password must include at least eight characters, with at least one letter and one number.

After setting your password, you can log in anytime using the Broker Portal Login page. For easy access, we recommend bookmarking the page.

If you experience any issues, your account executive is available to assist you in getting up and running.

Step two: Track and organize your loans in real-time

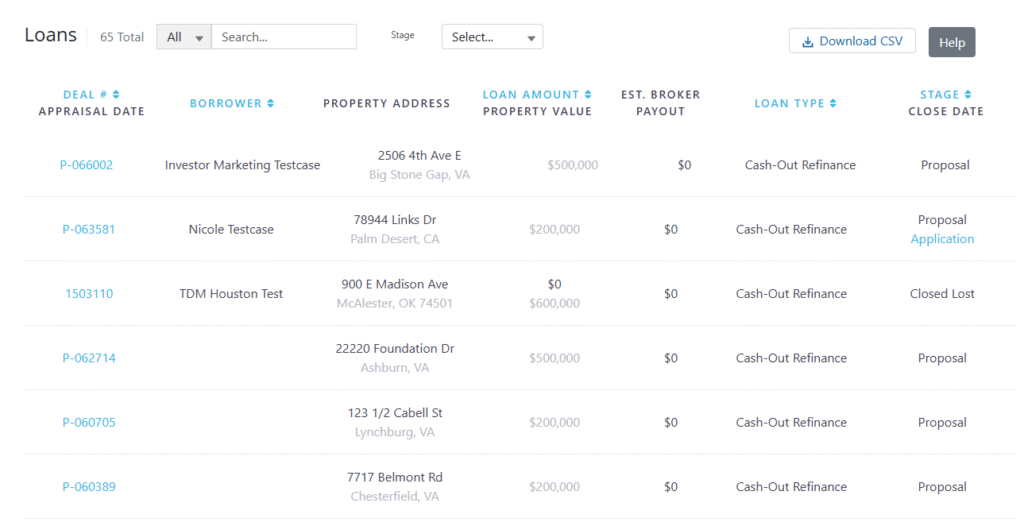

After setting up your account, you’ll land on the homepage, which serves as your dashboard for managing deals and tracking progress. From this central view, you can easily access your list of brokered loans along with essential details, including:

- Appraisal date

- Borrower information

- Property address

- Loan amount

- Estimated broker payout

- Loan type

- Stage of submission

You can also sort and filter your loan list by loan amount (from low to high or high to low), loan type (purchase, cash-out refinance or rate and term refinance) and deal stage. The stages include everything from proposal and application to underwriting, closing, and even marking a loan as won. These filters help you prioritize your pipeline and stay organized throughout every stage of the process.

Note: You can download your complete loan list as a CSV file for offline tracking or reporting.

Step three: From overview to deal details

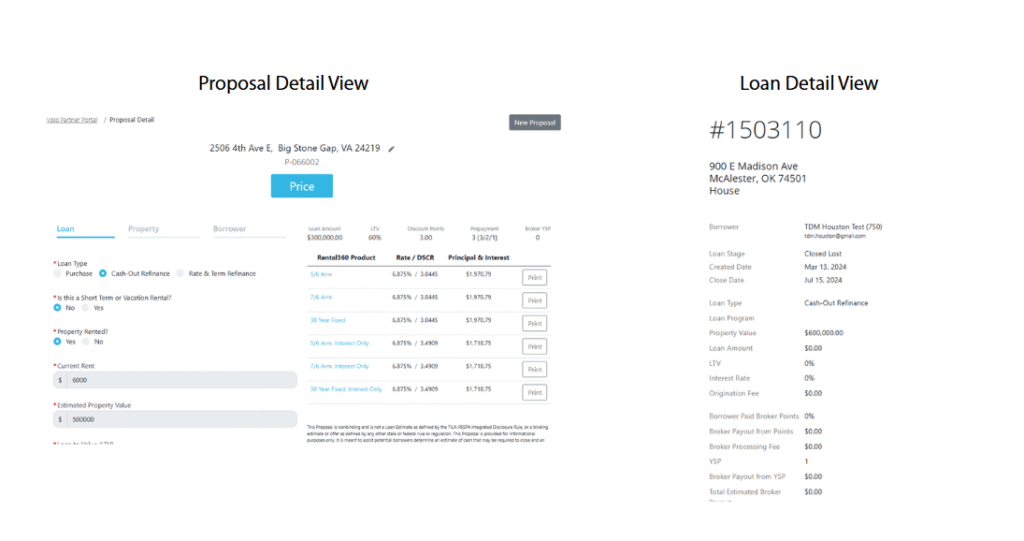

After reviewing your pipeline from the dashboard, you can dig deeper into individual deals for greater visibility and management. By clicking the deal number in your loan list, you’ll open the full deal view.

There are two main views available depending on the loan stage: Proposal Detail and Loan Detail. If the deal number starts with a “P,” the loan is still in the proposal stage. Here, you can make final updates to the deal, select the loan product and submit the online application on behalf of the borrower.

Once the borrower signs the application, the view transitions to the Loan Detail page. On the left side, you’ll see the loan fields, which include the finalized information from the proposal stage. The main section of the page is your document checklist. This is where you’ll upload the required items to move the loan forward.

Step four: Upload and manage loan files digitally

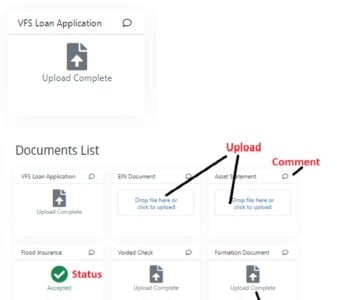

With your deal now in the Loan Detail view, the next step is to upload the required documents. The checklist on this page shows exactly what’s needed, making it easy to stay on track and keep the loan moving forward.

To upload a document, either click the file name in the checklist or drag and drop the file directly onto the screen. Once the upload is complete, a confirmation message will appear.

Each file is reviewed by the Visio team and marked accordingly. If a document is accepted, you’ll see a green checkmark next to the item, indicating it’s been conditionally approved pending underwriting review.

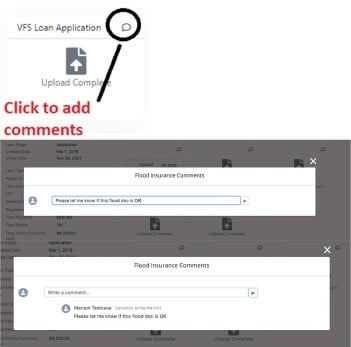

Step five: Use comments to stay in sync with the Visio staff

Instead of sifting through emails, the Visio Portal’s built-in comment tool consolidates all communication in one easily accessible location. Click the comment bubble next to any document to read or respond to messages related to that file.

Your account executive and processor regularly monitor these comments, allowing you to quickly ask clarifying questions and provide updates to keep the process moving forward.

Step six: Price a deal and submit to your account executive

Pricing a deal in the Broker Portal is fast and straightforward. Within a few minutes, you can determine preliminary pricing on a prospective property and send the deal through to your account executive.

To get started, click the “Start Loan Pricing” button near the top right of your portal dashboard, just above your loan list. Here, you can also view preliminary pricing without formally submitting a deal.

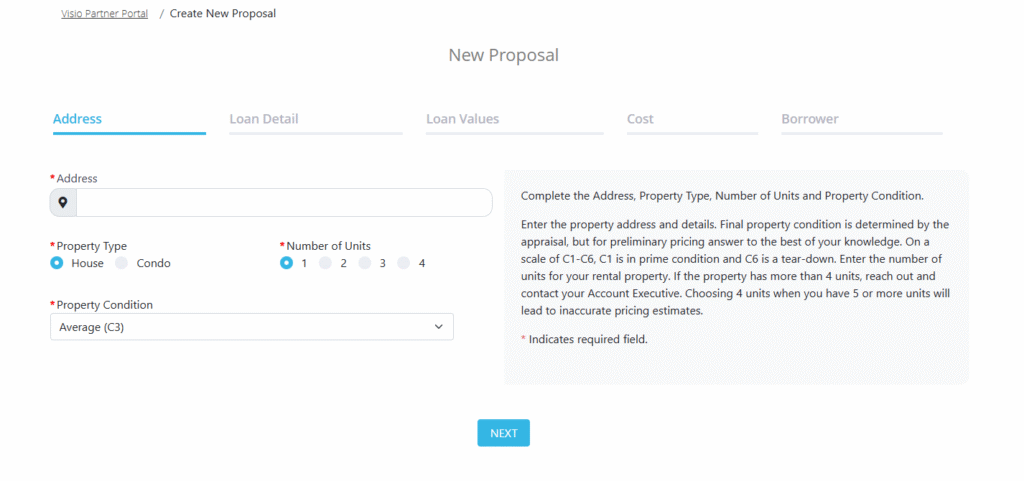

To create a new proposal, you’ll need to provide essential information such as the property address, loan details and values, costs and borrower information. Let’s take a closer look at each of these sections.

- Property Address: Enter the property address, condition (C1 for prime to C6 for tear-down) and number of units. For the condition, use your best estimate for preliminary pricing. If the property has more than four units, contact your account executive to ensure accurate pricing

- Loan Detail: Enter key loan details, including loan type and rental strategy (short- or long-term). For long-term rentals, include current rent or your estimate of market rent if the property isn’t rented yet

- Loan Values: Estimate the property value, then enter either your desired loan amount or LTV. Updating one will automatically calculate the other. You’ll also select your YSP, lender discount points and prepayment penalty structure (5/4/3/2/1, 3/2/1 or 3/0/0)

- Cost: Enter any monthly costs and fees so we can calculate PITIA (principal, interest, taxes, insurance and association dues), along with estimated title and closing fees, liens or existing payoffs on the property. To get a quick estimate of your DSCR, use our simple DSCR calculator

- Borrower Information: Enter an accurate estimate of the borrower’s credit score. This is essential for generating reliable pricing results. Then click “See Pricing Results” to view all qualified Rental360 products. Note: You’re not submitting anything to your account executive at this stage

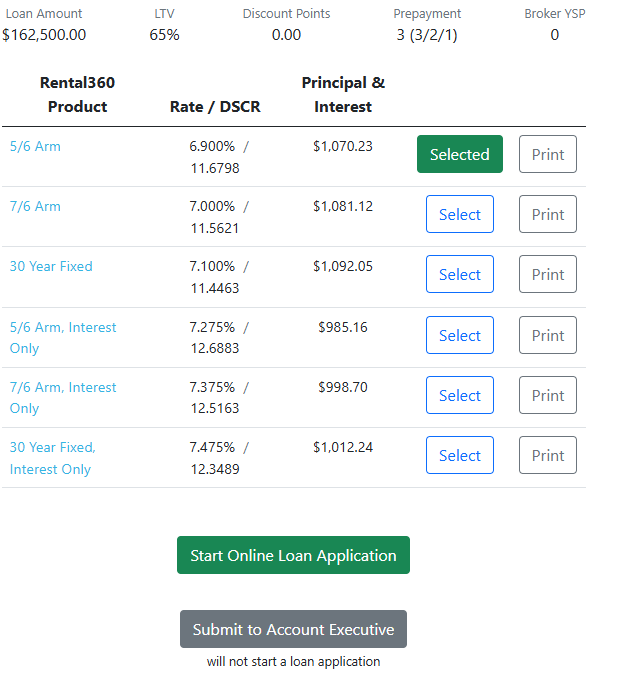

After entering all required information, click the “See Pricing Results” button at the bottom of the borrower section. This will open the Proposal Detail view with eligible loan products and preliminary pricing. Click “Select” on any product to view details. You can adjust variables such as LTV, prepayment penalty or points to see how they affect the quote. Remember, this proposal is non-binding and not a formal estimate.

Finally, you can either start the online loan application or submit the deal to your account executive. Please note that submitting does not initiate the loan application.

If you submit the deal to your account executive, a confirmation will appear on the screen, and your account executive will follow up with you directly. On the other hand, if you’re ready to start the application, you’ll be redirected to our online loan application system.

Visio Broker Program Highlights

While the portal is an integral part of the Visio experience, it’s only one aspect of the broader support we provide. As a Visio broker, you also gain access to a range of program benefits designed to elevate your success. Here are some key highlights of what the Visio Broker Program has to offer:

- Industry-Leading YSP Payouts: Charge up to 5% total, including up to 2% from our 4:1 YSP ratio

- Broker Toolkit: All-in-one access to marketing resources, sales tools and broker support materials

- Efficient, End-to-End Support: Our in-house processing and account executives manage the details so you can keep your pipeline moving

- Fewer regulations: No NMLS license is required to become a Visio Broker (except in California and Arizona)

Visio Broker Portal FAQs

How to reset my Broker Portal password?

If you’ve misplaced your password, you can reset it by clicking the “Forgot your password?” button on the login screen. Enter your username, and we’ll send password reset instructions to the email linked to your account.

How soon can I see loan status updates?

You’ll receive notifications at each stage of the loan process, so you’re always up to date on the status of your deal.

Can I price a deal without submitting it for review?

Yes! Click the “Start Loan Pricing” button near the top right of your portal dashboard, just above your loan list. After entering the necessary information, you can view preliminary pricing without formally submitting a deal.

Can my borrower fill out and sign the loan application directly?

Yes, and that’s the preferred method. Borrowers are encouraged to complete and sign the application themselves. However, many brokers choose to fill it out on their behalf to ensure all information is accurate before submission.

How do I update the broker fee after a loan is already in process?

To update the broker fee after a loan is already in process, contact your account executive directly.

What should I do if I request a password reset but don’t receive the email?

If you don’t receive the password reset email, check your junk or spam folder. If it’s not there, contact your account executive or processor for help.

Is there a way to remove or close out proposals that aren’t moving forward?

The current version of the portal doesn’t allow you to remove or close out proposals that aren’t moving forward, but you can filter your loan list based on the stage of the loan process.

How can I update my email address in the Broker Portal?

You can’t update your email address in the Broker Portal at this time. If you need to make a change, please contact your account executive for assistance.

What types of documents does the Visio Broker Portal accept?

The portal accepts PDFs and Word documents, though PDFs are strongly preferred for faster processing and fewer formatting issues.

Why am I not receiving a quote after entering loan information?

If you’re not seeing a quote, it usually means the pricing engine can’t return results due to missing or inaccurate inputs. Double-check all fields for errors or unrealistic values, especially in areas like LTV, credit score or property details.