Securing a loan to invest in rental property is just the first step in a successful real estate venture. Landlords typically want to choose the best potential tenants when screening applicants.

An excellent credit score, high income, and prior on-time payments indicate a trustworthy tenant who is more likely to make their lease payments on time. However, applicants who meet these criteria aren’t always an option, meaning you may have to consider potential tenants with a guarantor or cosigner instead.

Read on to learn more about guarantor vs. cosigner, including the legal obligations of each, the primary differences, and when you might consider applicants with either option.

What is a guarantor?

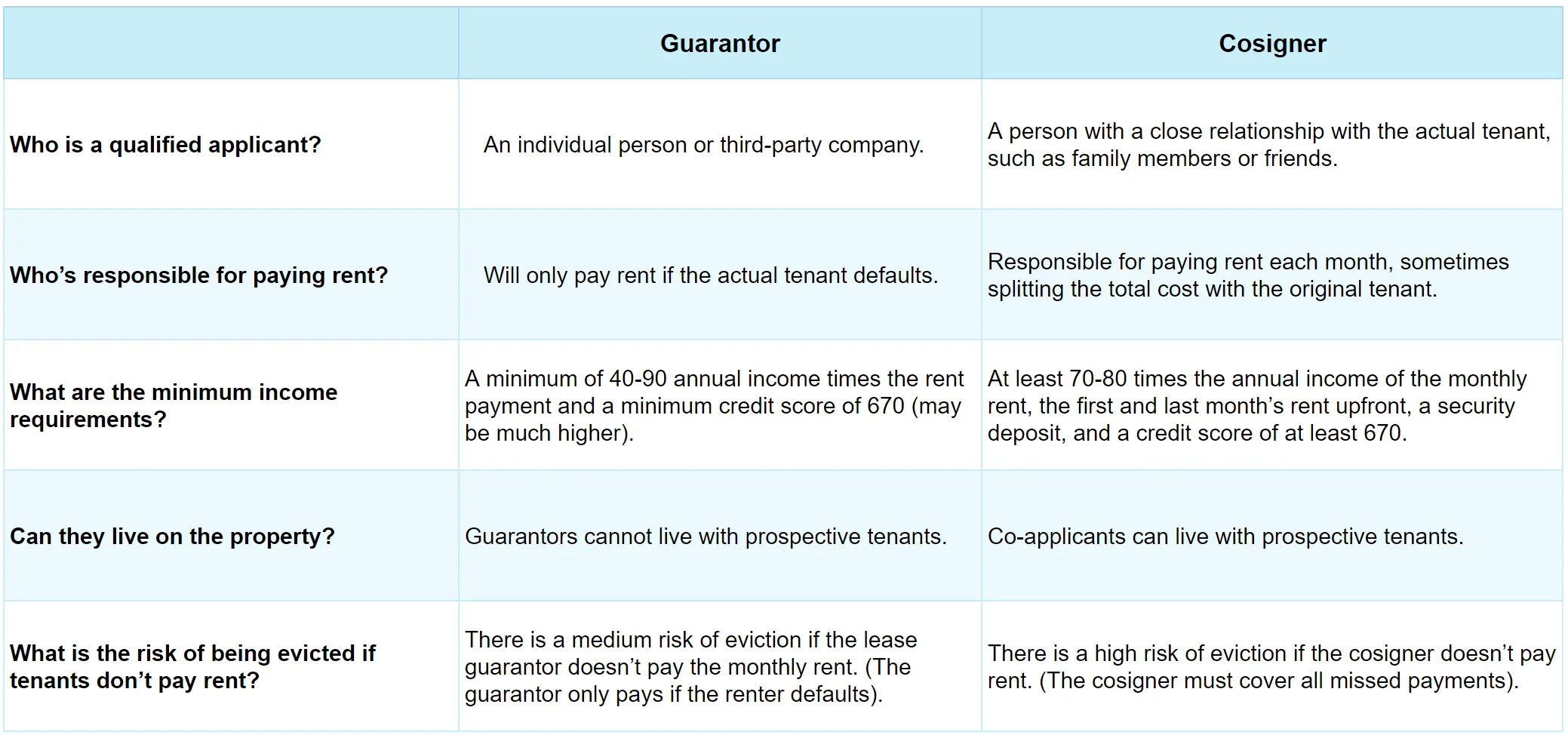

A guarantor is a third-party person or company who signs on behalf of the renter. If the tenant fails to make prompt rent payments and defaults, the lease guarantor is financially responsible. The rent guarantor has no additional responsibilities unless the tenant defaults on the lease agreement.

A guarantor can be any person over the age of 18 years with a good credit report and sufficient income. A guarantor doesn’t live on the property. Sometimes, an applicant may work with a lease guarantor company, which agrees to pay if the tenant defaults.

What is a cosigner?

A cosigner is a co-owner listed on the lease agreement. The cosigner has a financial responsibility to pay rent, maintain the property, and avoid missed payments. Since a cosigner holds more financial responsibility, they’re typically closer to the prospective tenant, such as a family member or close friend. A cosigner is more likely to live in the rental property.

Both signers are ultimately responsible for payments, even in split-rent agreements with a co-renter. If one renter stops paying, the other tenant must cover the full portion of the lease payment.

Guarantor vs. Cosigner: The Differences

Both cosigners and guarantors sign the lease and agree to be liable if the tenant fails to pay rent or the rental property. Still, here are the main things you need to know about the differences between a cosigner and a guarantor:

When should renters get a cosigner vs. guarantor?

Here are a few situations in which prospective tenants may require a cosigner or guarantor:

When a lease guarantor may be necessary:

- Poor credit history – A guarantor can minimize landlord risk for tenants with a poor credit history, such as previous bankruptcies or evictions

- Low income with minimal job experience – Guarantors may sign for applicants with income that doesn’t meet the minimum requirements or those with an unsteady job history.

- No rental history – Landlords may be more likely to approve leases from applicants without prior rental history if they have a guarantor.

- Unstable plans – A lease guarantor can make an application stronger for potential tenants who may be less likely to complete the contract length.

When a cosigner may be recommended:

- Applicants without credit or rental history – A cosigner can be an excellent backup plan for applicants without previous credit.

- Unable to meet security deposit requirements – A financially stable cosigner can help a tenant who does not have the required security deposit secure housing.

- Applicants who work in volatile job markets –Co-applicants may be a good backup plan for applicants who work in volatile job markets.

- Applicants who want to avoid a higher security deposit – Landlords may charge a higher deposit for tenants with lower credit scores, and co-applicants with good credit can reduce this cost.

How do landlords screen cosigners and guarantors?

Whether using a cosigner or guarantor, property managers and landlords will want to conduct a thorough screening before they accept tenants. The screening process may look a little different based on individual property managers’ preferences and the specific requirements of the rental lease. However, there isn’t much difference between screening cosigners and guarantors.

After reviewing rental applications, property managers will review the prior rental history of the cosigner or guarantor. Some landlords may even contact previous landlords to ensure the applicant met all their previous financial responsibilities. A potential landlord will also need to check the guarantor’s or the cosigner’s employment history to ensure a steady income.

Since the total financial responsibility falls on the guarantor or cosigner, they must meet the landlord’s income requirements. This may include a review of bank statements to ensure the cosigner has sufficient steady income to cover the rental lease price. A review of credit history is also necessary to ensure the cosigner or guarantor is the most qualified applicant. Finally, most landlords require a background check.

And finally, while a landlord can screen applicants based on a good credit score or pay stubs, they must always follow fair housing laws, meaning they cannot prioritize applicants based on color, gender, family, or other protected categories.

Do landlords prioritize lease agreement tenants without a cosigner or guarantor?

Tenant applications require potential tenants to prove they can pay the rent on time, take good care of the property, and that they fit the landlord’s lifestyle requirements.

Some landlords may prioritize applicants with cosigners and guarantors if it makes their application stronger.

Pros of applicants with rent guarantors or cosignersHere are a few pros of applicants with rent guarantors or cosigners:

| Cons of applicants with rent guarantors or cosignersAnd here are a few cons:

|

This doesn’t necessarily mean that all landlords will choose applicants with a cosigner or guarantor over a potential tenant without. A good tenant with on-time rent and lease payments, a good credit history, and sufficient income can be just as strong of an applicant as a tenant with less income, an average credit score, and minimal or no lease experience with a co-applicant.

The significant difference between an applicant with a cosigner/guarantor and one without is that two parties are financially responsible if the tenant doesn’t maintain their lease obligations. In some cases, a tenant with a guarantor may be a more qualified tenant than one without.

When should a landlord require a guarantor or cosigner?

Landlords may want to consider a guarantor or co-applicant in the following situations:

- When an applicant is financially secure but has a previous eviction or late payments.

- When an applicant has no rent or lease history.

- When an applicant has a limited job history or doesn’t meet the financial requirements.

- When a rental application includes a prospective tenant with poor or fair credit.

- When an applicant’s income or living citation needs are likely to change.

Can tenants have more than one guarantor?

A prospective tenant shouldn’t have more than one guarantor or cosigner. A guarantor and a cosigner are designed to offer financial peace to the landlord, but dividing responsibility among too many people can complicate the process. Tracking the month’s rent can be difficult if multiple parties are equally responsible. Additionally, determining who to take to court can be overwhelming if there are too many signers and the tenant defaults.

Does a cosigner have to present when signing a lease?

Many landlords require the cosigner to be present when signing a lease, but this may vary. Requiring the cosigner to be present ensures they understand they’re jointly responsible and helps the landlord mitigate risk. In-person signing also ensures the cosigner is aware of the unique stipulations of the contract, including the rent payment date and any associated late fees. Some landlords may allow a cosigner or guarantor to sign a lease remotely but will usually require the document notarized.

Does a tenant need proof of income if they have a cosigner?

Yes, even with a cosigner, a tenant will usually still need proof of income. Proof of sufficient income is also required for both a cosigner and a guarantor. Landlords will typically consider everyone’s income when choosing the best tenant for their rental property. This is why having a co-applicant or guarantor can help low-income applicants find housing.