Tenant turnover is costly. To be precise, the total average cost of a vacant unit during tenant turnover is $1,750 per month (source: Transunion). Tenant turnover is also time consuming, given that you have to clean the property, repair any damage, advertise the property, hold open houses, process applicants, and screen applicants. The bottom line: finding and retaining solid tenants is a crucial piece of profitability for buy and hold investors.

Creating a sound tenant strategy can be invaluable in finding and maintaining excellent tenants. Interestingly, renter preferences vary widely by demographic. In a January 2023 survey, we polled 1,752 U.S. adults who currently live in a long-term rental home, and the results came back mixed by generation.

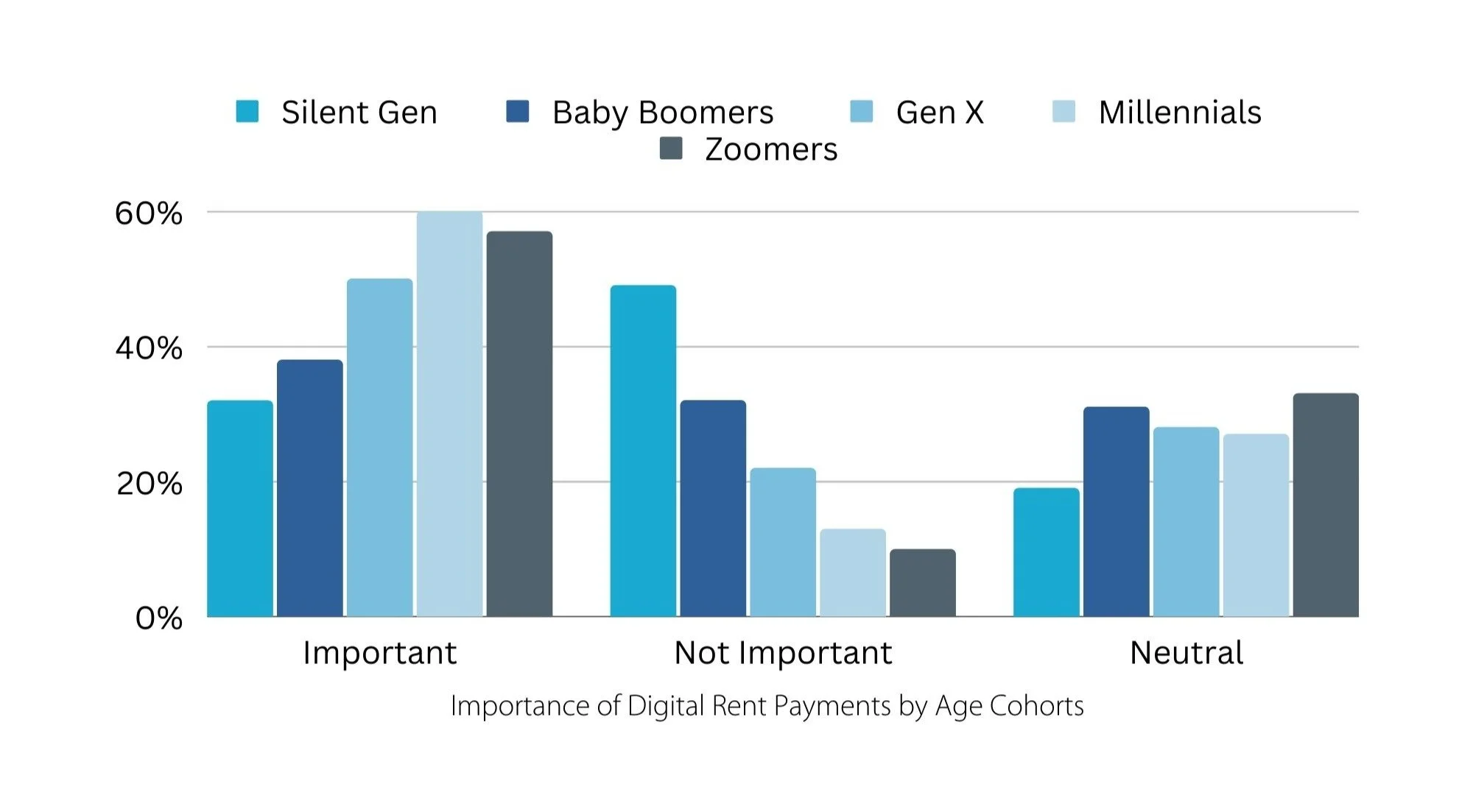

For example, when asked about how important it is to have a digital rent payment method, millennial tenants were 30% more likely to say it was important than any other age group. Baby boomer renters, on the other hand, are 88% more likely than any other age group to say it is NOT important to have a digital rent payment method. There is a clear correlation between age and digital preferences.

Our survey further revealed how demographic data can help landlords make informed purchases for new properties as well as cater their current properties and management practices to their ideal tenants. In this post, we’ll take a look at:

Baby Boomers (Born 1946 to 1964)

- An Overview of Boomer Renters

- What Boomers Look For in Rentals

- Best Ways to Market and Cater to Boomers

Millennials (Born 1981 to 1996) - Pros of Targeting Millennials

- What Millennials Look For in Rentals

- Best Ways to Market and Cater to Millennials

Gen Zers (Born 1997 to 2012) - Meet Gen Z Renters

- What Gen Zers Look For in Rentals

- Best Ways to Market and Cater to Gen Z

Baby Boomers, “Everything is Possible” Generation

Baby Boomers, born 1946 to 1964, are the generation born in the aftermath of World War II. Some key characteristics of this generation, as outlined by FamilySearch.org, are they value relationships, they are goal centric, and they are resourceful. With these central themes in mind, let’s take a look at what our survey revealed about Baby Boomers as renters, including why you should target them and how to cater to them.

Satisfied and Settled

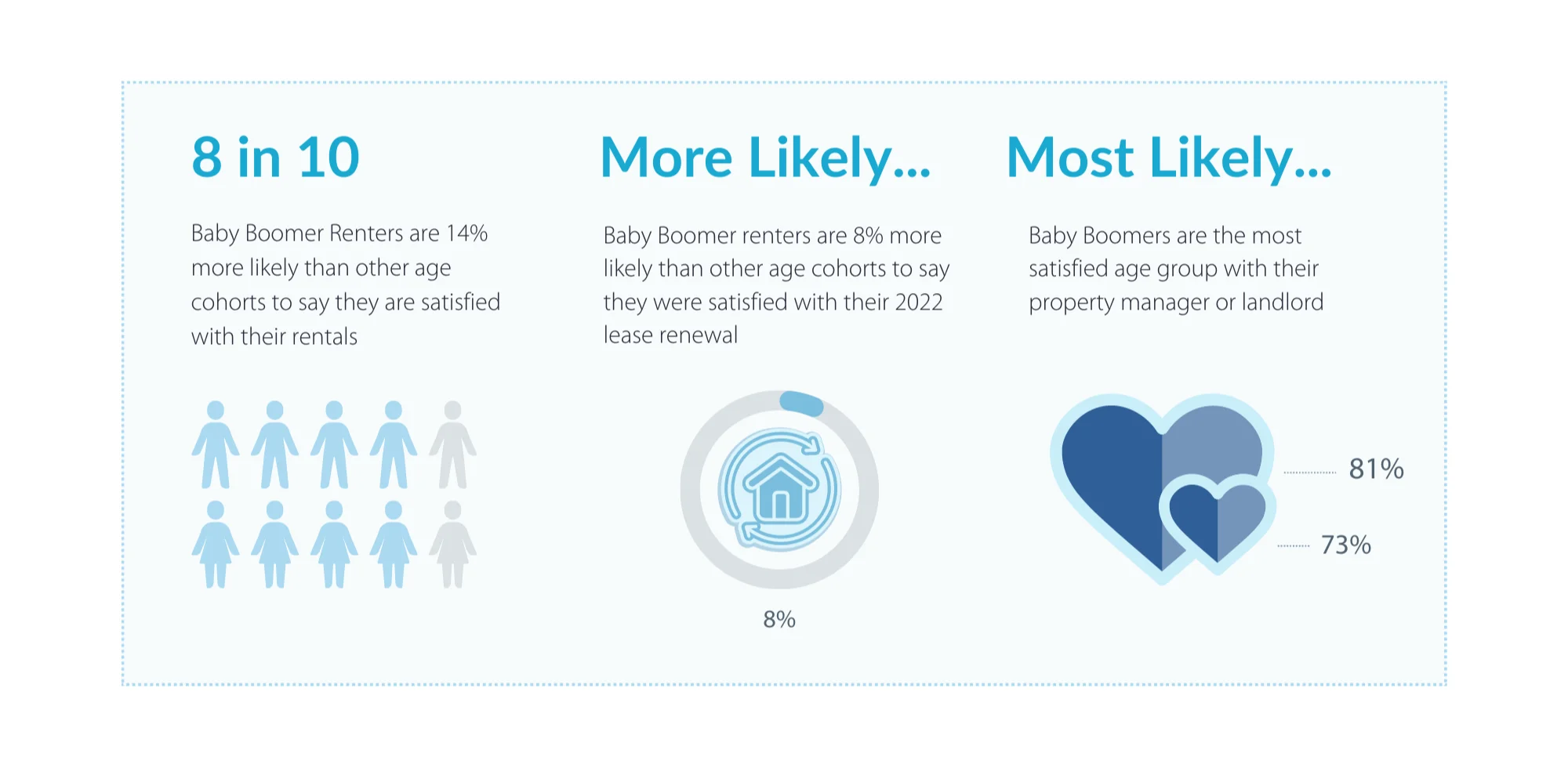

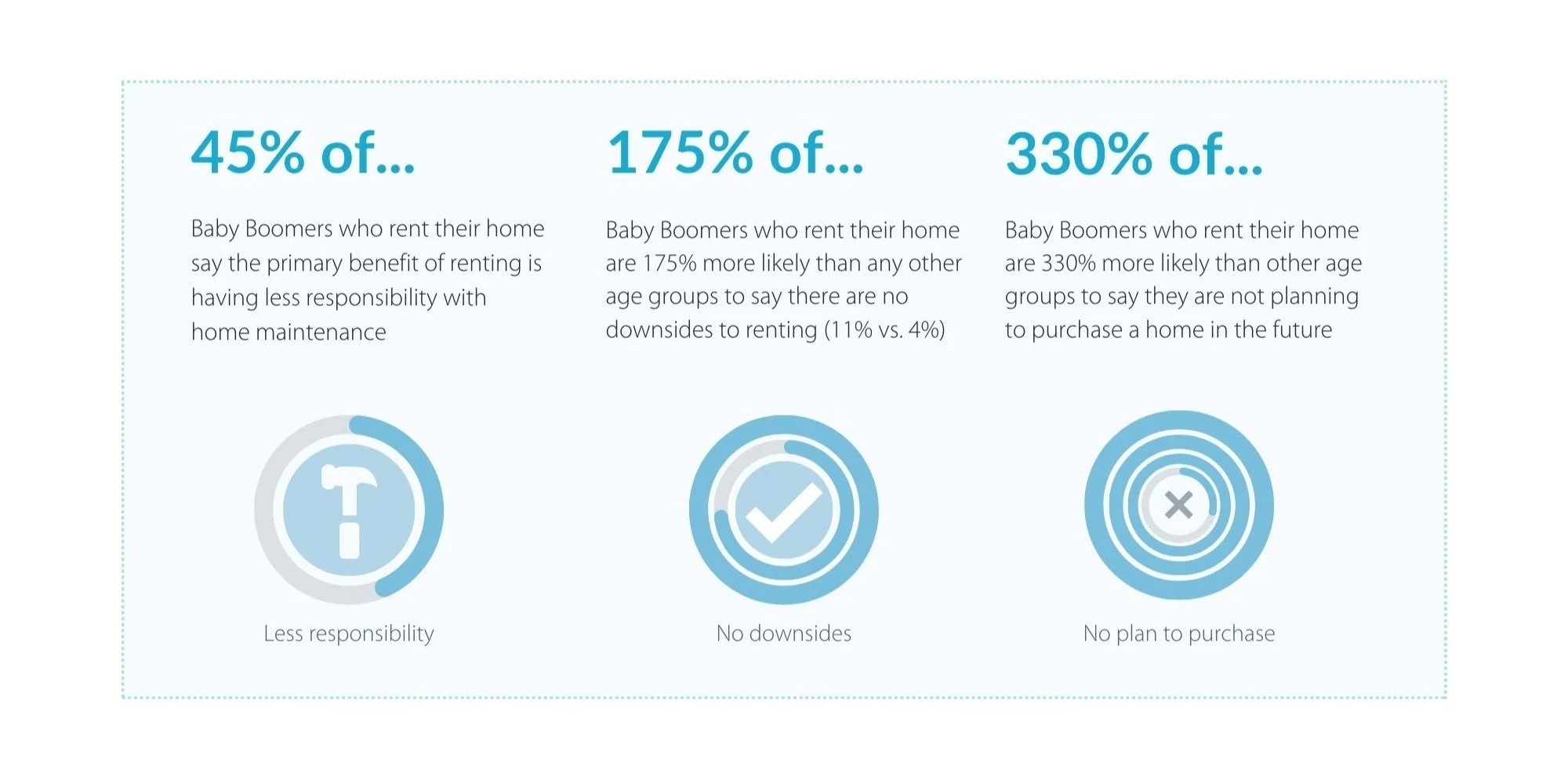

Baby Boomers who rent their homes are more likely to be satisfied with their rental and to have intentions to rent long-term, making them a great target for low-maintenance, low-turnover tenants. However, they likely have a smaller monthly rental budget than other age cohorts, which means you need to be mindful of costs if targeting this group. Let’s look at some survey stats to support this data.

Baby Boomers are More Satisfied Renters than Other Age Cohorts

U.S. Baby Boomers who rent their home are 14% more likely than any other age group to say they are satisfied with their current rental home, and 8% more likely to say they are satisfied with their property managers and/or landlords. They are also 30% less likely than any other age group to negotiate their rent. Essentially, Boomers are easy to please and very accommodating.

Baby Boomers are Looking to Stay Put

U.S. Baby Boomers who rent their home are 74% more likely than any other age group to cite not wanting the responsibility of a home as one of the reasons they choose to rent. Baby boomers value low maintenance, and nearly half of Baby Boomers (47%) said they rent for that reason. When compared to other age groups, Baby Boomers are 330% more likely to say they are not planning to purchase a home in the future. This generation is retiring and selling their homes to rid themselves of the maintenance and responsibilities.

Baby Boomers Pay Less Rent

The most common rent bracket for Baby Boomers is $800 or less on monthly rent. The second most common rent bracket Boomers pay is $1,001-$1,500 per month. Given their retirements, it is sensible that Baby Boomers pay less than their working age cohorts.

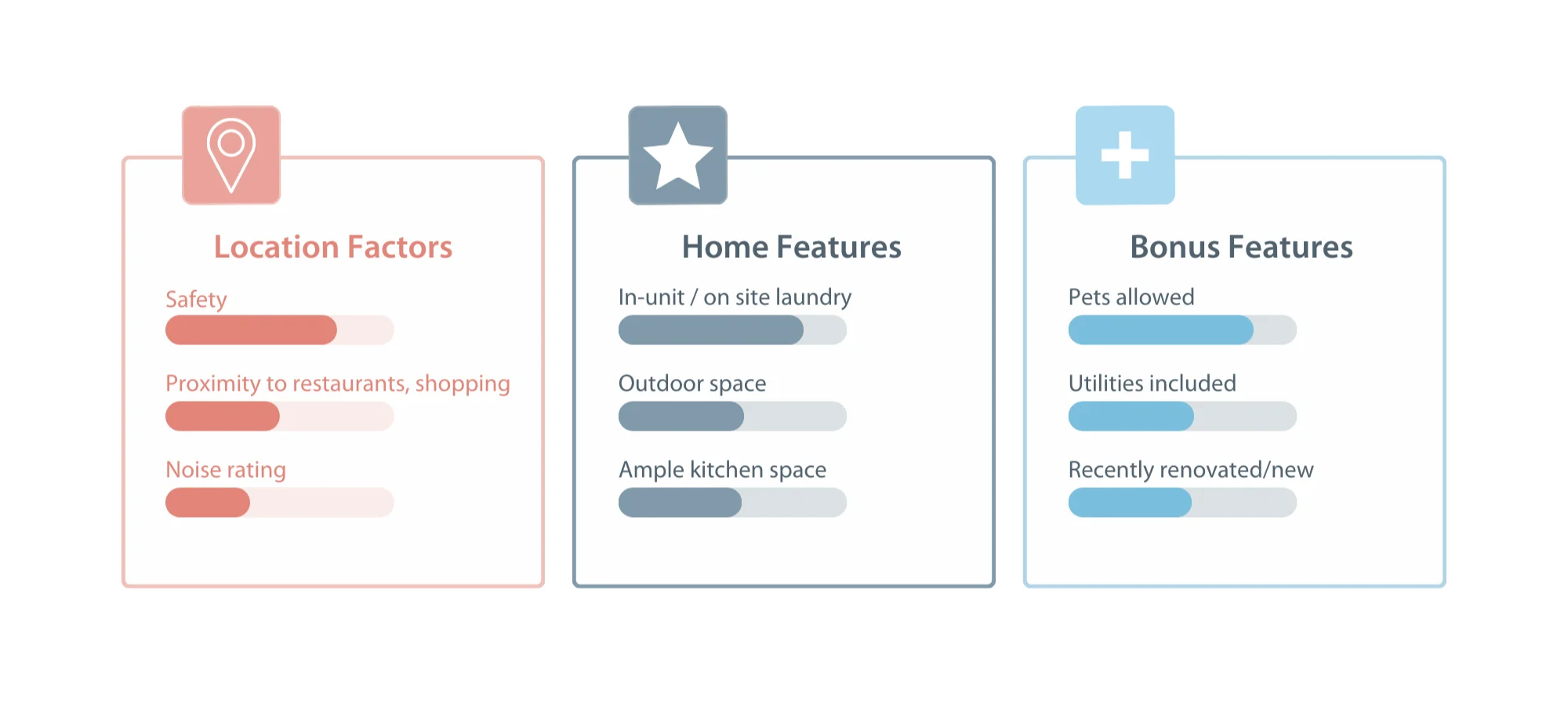

Safety, Simplicity, and Sociability

When looking for a rental home, Boomers prioritize safety, proximity to restaurants, shopping, and entertainment, and low noise level. Compared to other age groups, Baby Boomers indexed higher (25% more) for considering proximity to restaurants, shopping and entertainment, as well as higher (41% more) for considering proximity to parks and green spaces. Since they are retired or are approaching retirement, it makes sense that Boomers are interested in their social lives and activities.

In terms of amenities, Baby Boomers are again prioritizing socialization as well as convenience. Over half of Baby Boomers said both an outdoor space (55%) and ample kitchen space (54%) are necessities when selecting a home. These are both great spaces for entertaining friends or grandchildren. Additionally, 81% of Boomers who rent their homes said on-site or in-unit laundry is a necessity, 11% more than any other age group.

Easy to Reach, Easy to Please

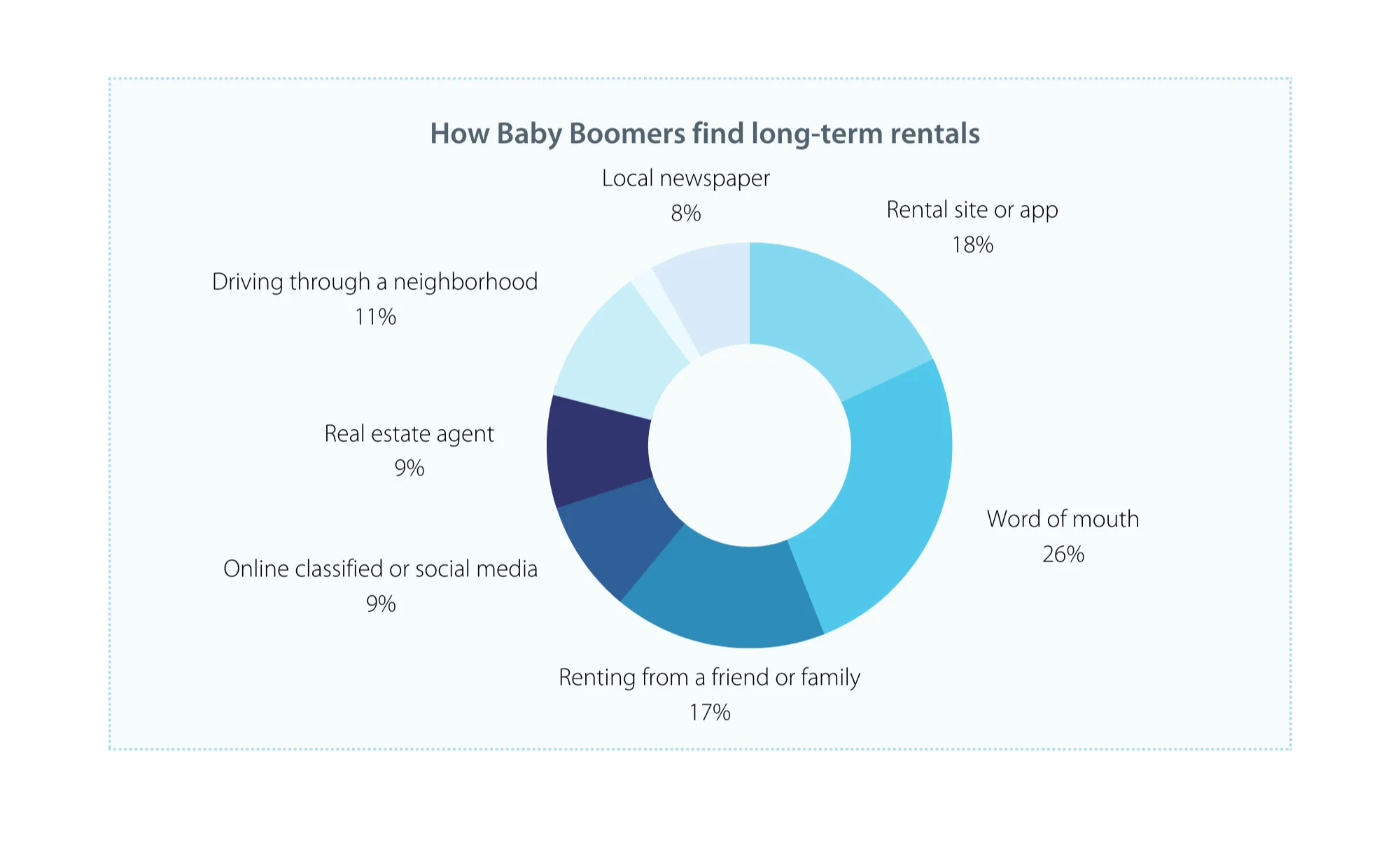

The most common ways Baby Boomers cited finding their current rental home includes Word of Mouth (26%), rental listing app or site (18%), or renting from a friend or a family (17%). Though these are the top three, the other methods including working with a real estate agent, driving neighborhoods, newspaper ads, and online classifieds were not far behind. Essentially, no matter where you market your rental, you could have the eyes and ears of Baby Boomers.

Boomers are also the most satisfied age group of renters across the board. When asked about their communication methods with landlords, their property managers in general, and their lease renewal process, Baby Boomers indexed high in terms of satisfaction.

Millennials, The Digital Natives

Born between 1981 and 1996, according to Business News Daily, millennials are the largest living age group with a population of 83.1 million. Business News Daily defined some key characteristics of millennials to include that they are technology savvy, crave work-life balance, and have fickle loyalty. Let’s take a closer look at this demographic, why you should rent to them, and how to optimize your millennial strategy.

Eager to Purchase, Yet Financially Restrained

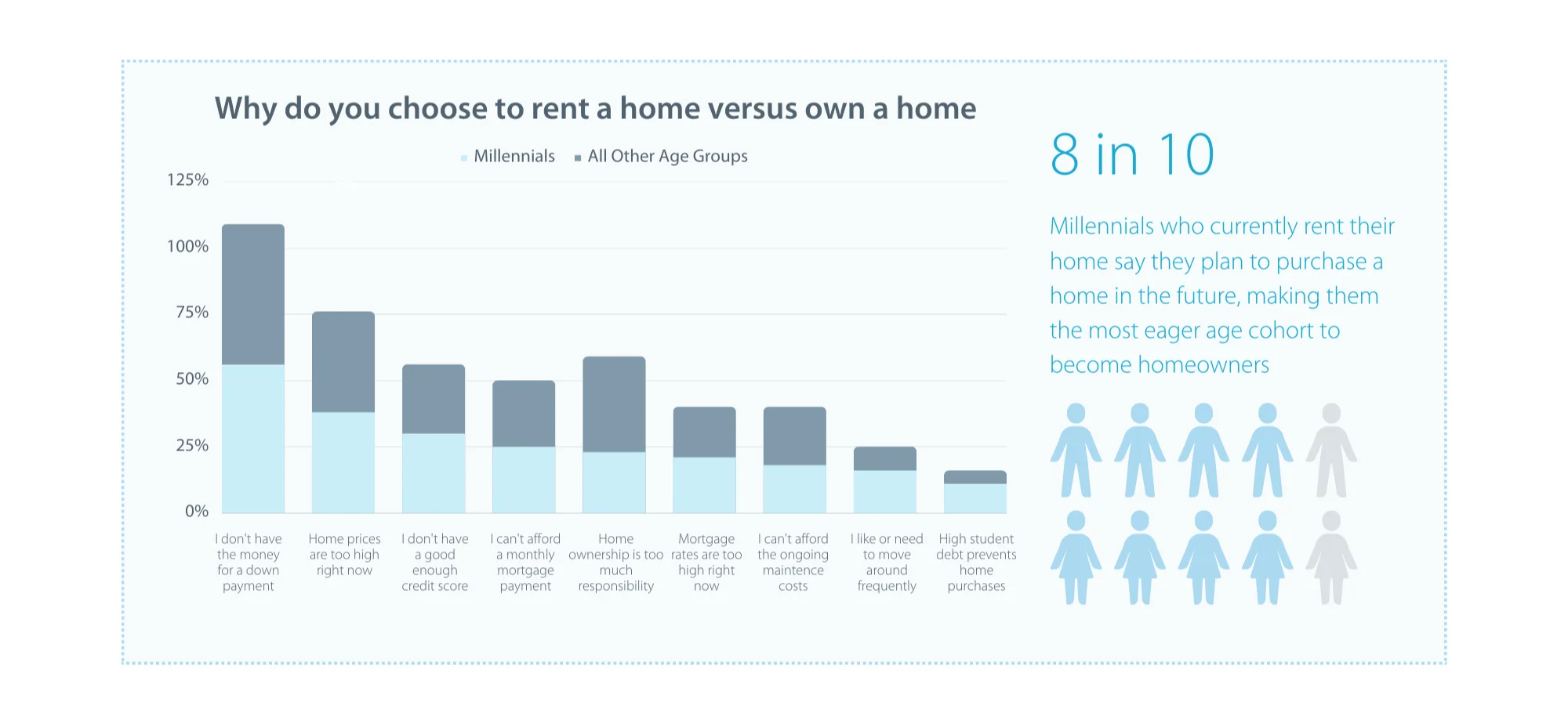

Millennials are eager to purchase homes, however they have financial barriers to entry which may keep them in rentals long-term. Our survey found that U.S. Millennials who rent their home are 64% more likely than other age groups to say they are planning to purchase a home in the future. However the top three most common reasons why Millennials are currently renting versus buying a home are:

- They don’t have the money for a down payment – 51%

- Home prices are too high right now – 38%

- They don’t feel they have a good enough credit score – 30%

Further, when asked when they plan on purchasing a home, nearly half of millennials said they plan to wait 4 or more years. Whether by choice or not, this age group has a large population of renters who landlords should consider targeting.

Furry Friends and Families First

When looking for a rental home, millennials want something to accommodate their pets and children. For example, 74% of millennial renters currently are in single-family homes, making them the most likely age cohort to rent this type of property. Single-family homes are arguably the most family-friendly property type.

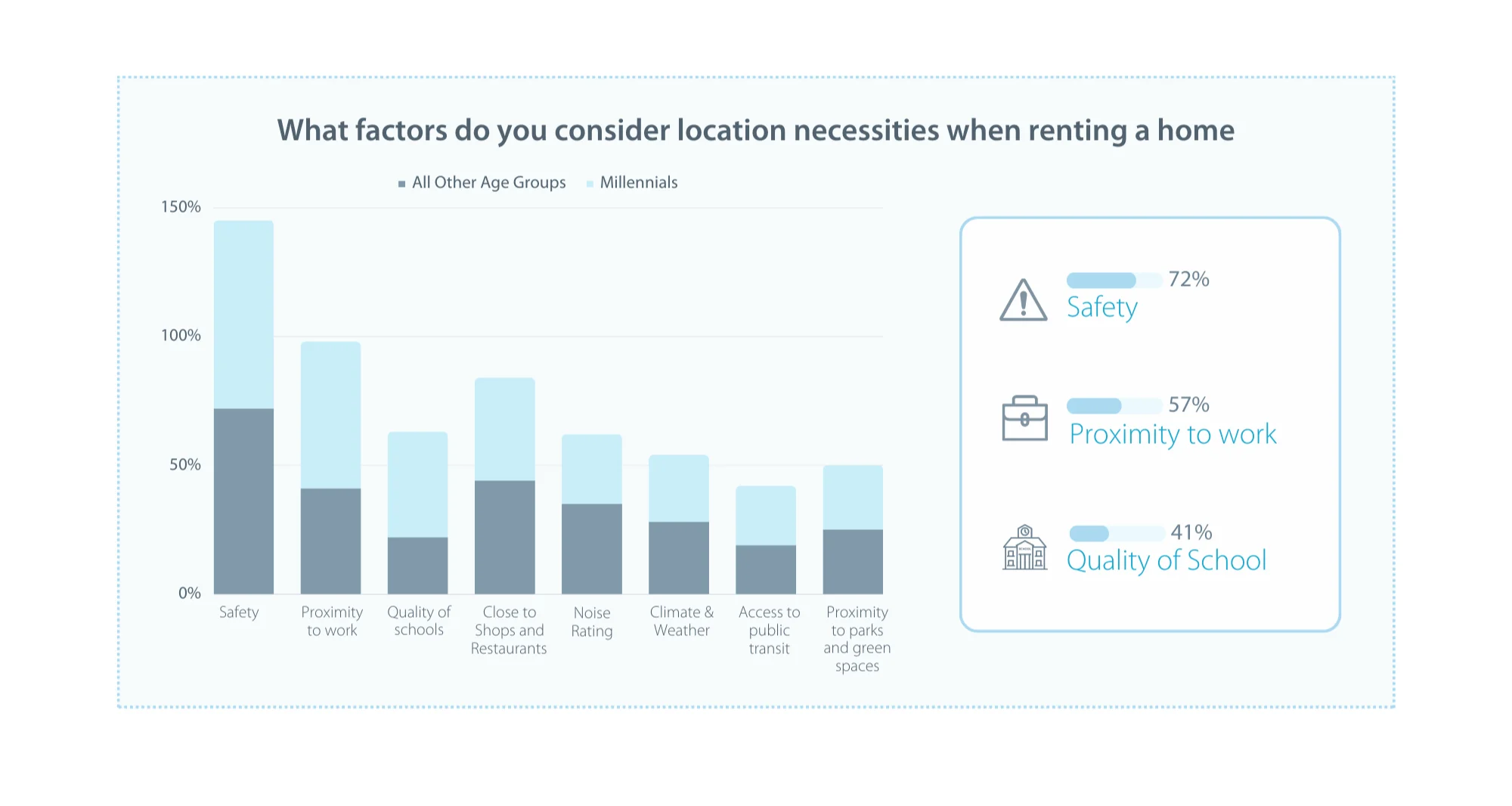

Family-friendly features and amenities further are top considerations for millennials including, safety, proximity to work, and quality of schools. In fact, U.S. millennials who rent their home are 86% more likely than any other age group to say they consider the quality of schools or school zones a necessity when selecting a rental home.

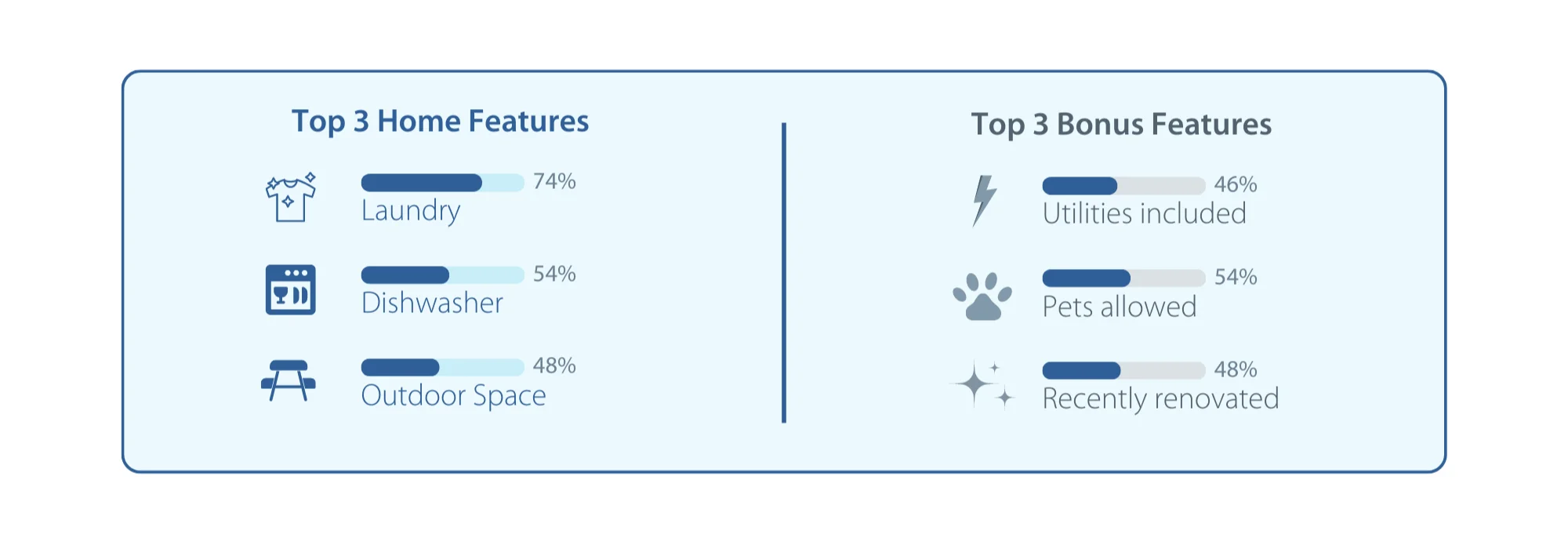

In terms of amenities, millennials prioritize laundry, outdoor space and a dishwasher. And don’t forget Fido. 68% of millennials said pets being allowed at their rental is a necessity.

Go Digital to Cater to Millennials

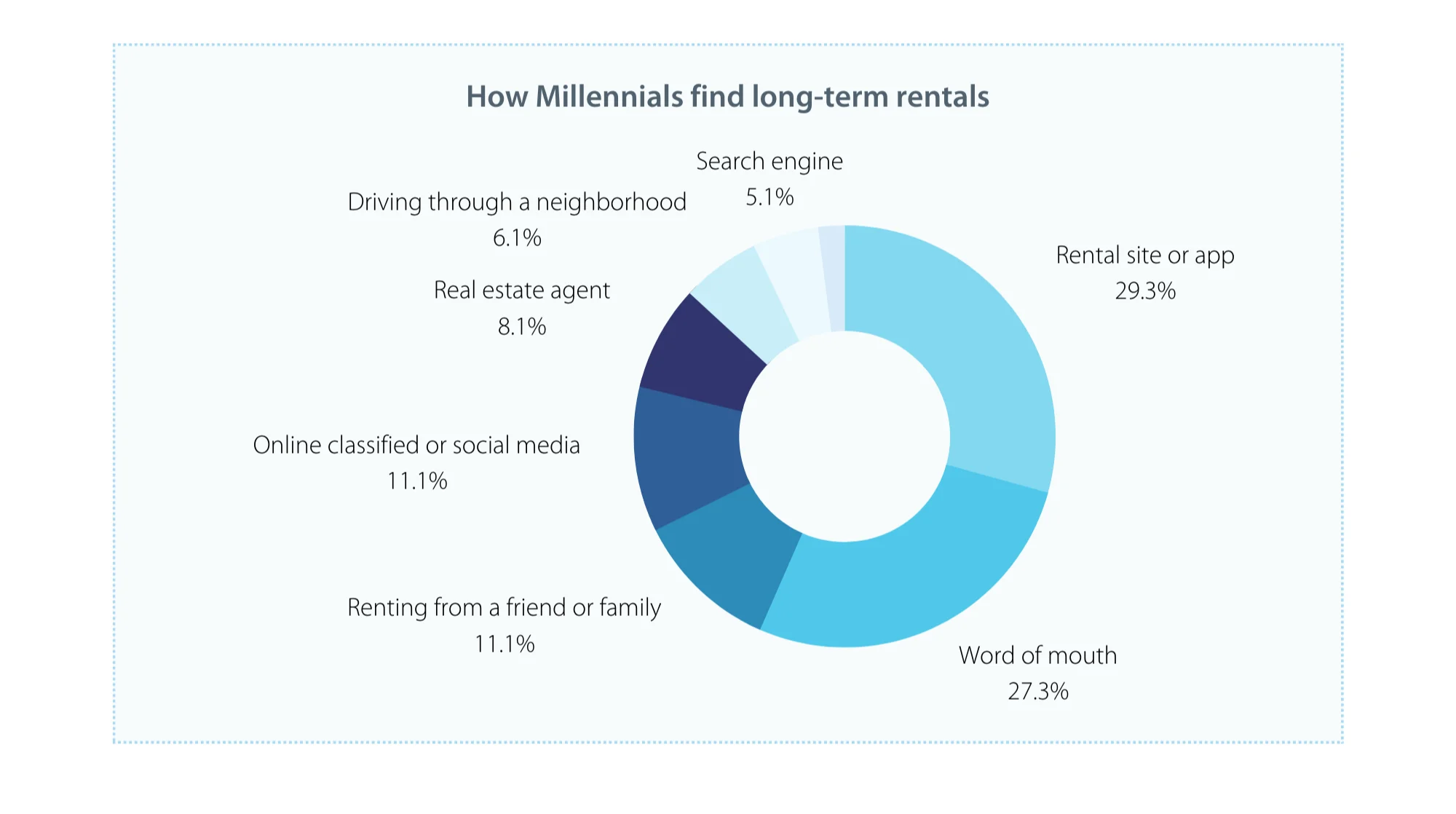

The most common ways Millennials cited finding their current rental home include rental listing sites or apps, Word of Mouth, and online classifieds:

- Rental listing site or app (like Zillow) – 29%

- Online classified or social media (Craigslist, Facebook Marketplace) or renting from a friend or family are tied – 11%

Millennials are 32% more likely than other age groups to say they found the property they’re currently renting through a rental listing site or app. They are the group most often looking online.

A digital approach is key for millennials in management style as well. Over half of millennials (60%) said that a digital payment method for rent was important.

Additionally, our survey found that the primary method of landlord/tenant communication is via text message, and 77% of millennials are satisfied with this primary method of communication.

Generation Z or “Zoomers”

Born between 1997 and 2012, Gen Zers prioritize mental health and flexibility, are willing to make changes, and strive for connection (Source: U.S. News). Let’s take a closer look at this demographic, including our survey findings on what makes them great target renters and how to cater to them.Gen Zers are likely to live in a home with a higher monthly rent and home ownership is a farther off goal for them than any other age group, making them a core audience for long-term rental property owners. However, Gen Zers may move more frequently than any other age groups, resulting in tenant turnover. While the higher turnover rates can be costly, you may be able to frequently increase rent rates and charge more rent if you lease to Zoomers. Below are some survey stats to support this data.

High Paying, Short Staying Tenants

Gen Zers are likely to live in a home with a higher monthly rent and home ownership is a farther off goal for them than any other age group, making them a core audience for long-term rental property owners. However, Gen Zers may move more frequently than any other age groups, resulting in tenant turnover. While the higher turnover rates can be costly, you may be able to frequently increase rent rates and charge more rent if you lease to Zoomers. Below are some survey stats to support this data.

Gen Zers Pay More Rent than Other Age Cohorts

Although the percentage is small, Gen Zers are 200% more likely to pay $3,001-$3,500 per month for rent than any other age group. Gen Zers are also 29% less likely to pay $800 or less for their monthly rent when compared to other age groups. The most common rent payments for Zoomers are:

- $1,0001-$1,500 per month- 24%

- $1,500-$2,000 per month- 19%

- $801-$1,000 per month- 17%

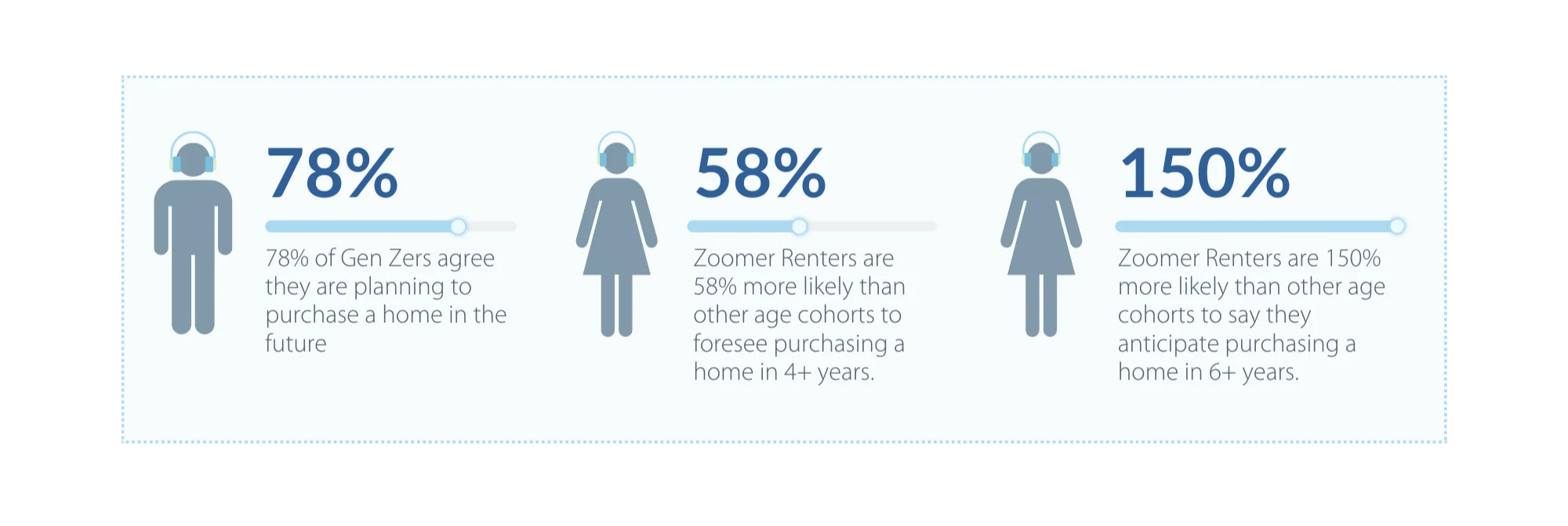

Gen Zers Want to Buy Homes, but Not Anytime Soon

U.S. Gen Zers who rent their home are 42% more likely than other age groups to say they agree that they are planning to purchase a home in the future. However, the future for them is mostly four years or more away. To be specific, Zoomers are 58% more likely than other age groups to say they anticipate purchasing a home in four to six years and 150% more likely than other age groups to say they anticipate purchasing a home in over six years.

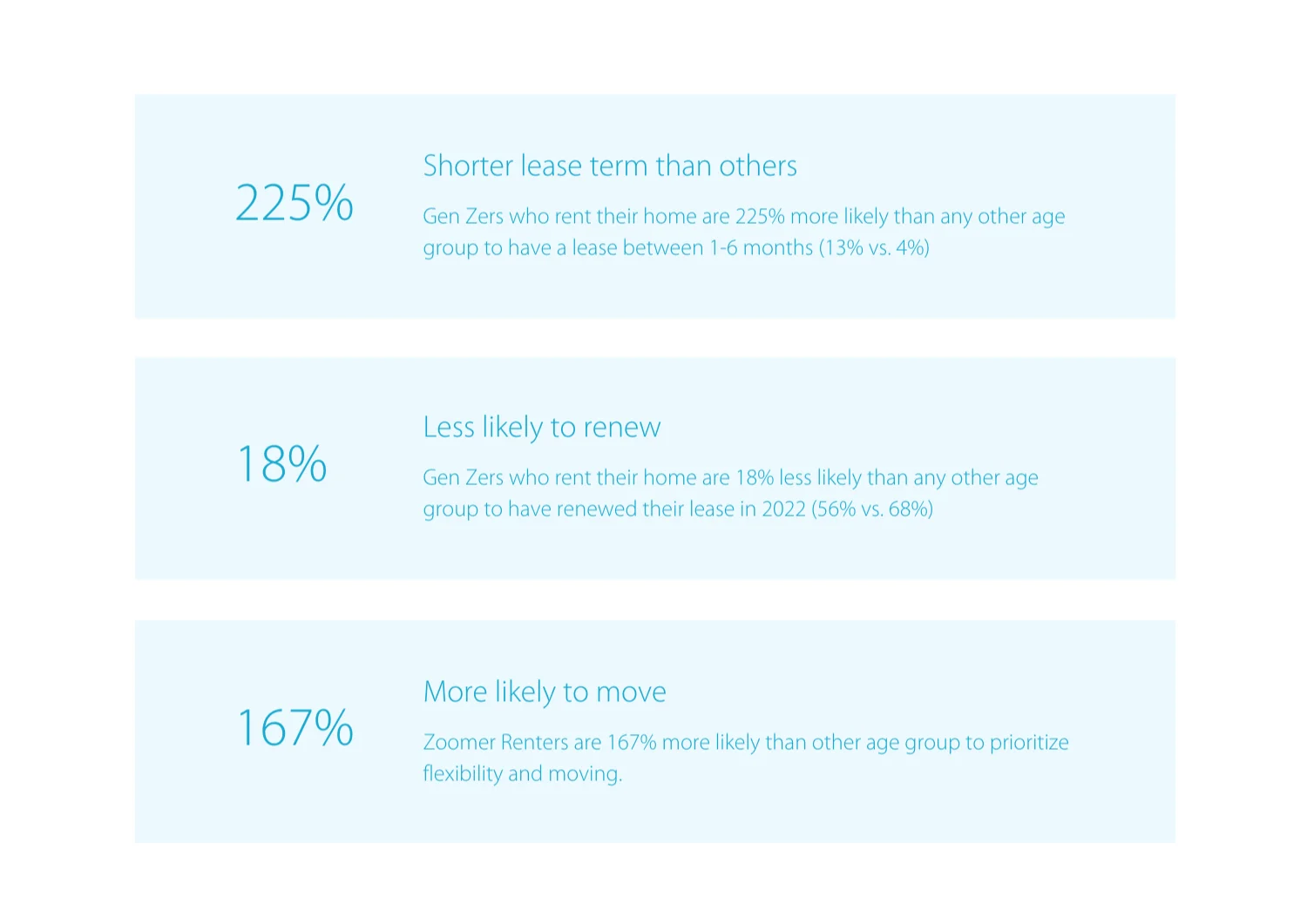

Gen Zers are on the Move

Gen Zers who rent their home are 225% more likely than any other age group to have a lease between 1-6 months. This relates to their values of flexibility and openness to change. Compared to all other age cohorts, Gen Zers are 167% more likely to cite liking or needing to move around frequently as why they choose to rent. They are also 74% more likely than any other age group to say the primary benefit of renting is the flexibility provided.

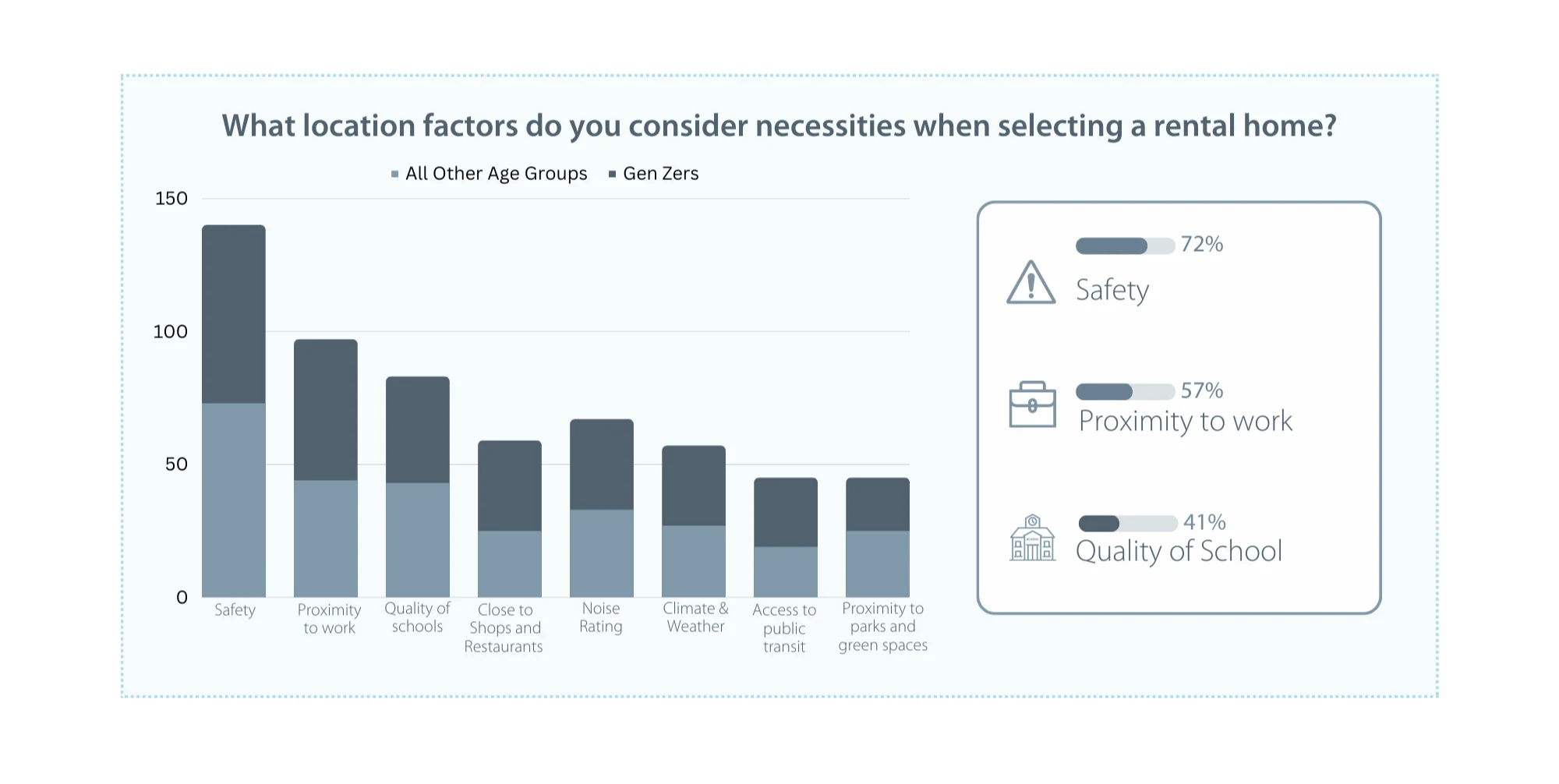

Work Hard, Play Hard

In terms of location, Gen Zers prioritize being close to work as well as restaurants, shopping, and entertainment. More than half of Gen Zers (53%) said that proximity to work is a necessity when selecting their rental, and 40% said that proximity to restaurants, shopping, and entertainment is a necessity when selecting their rental.

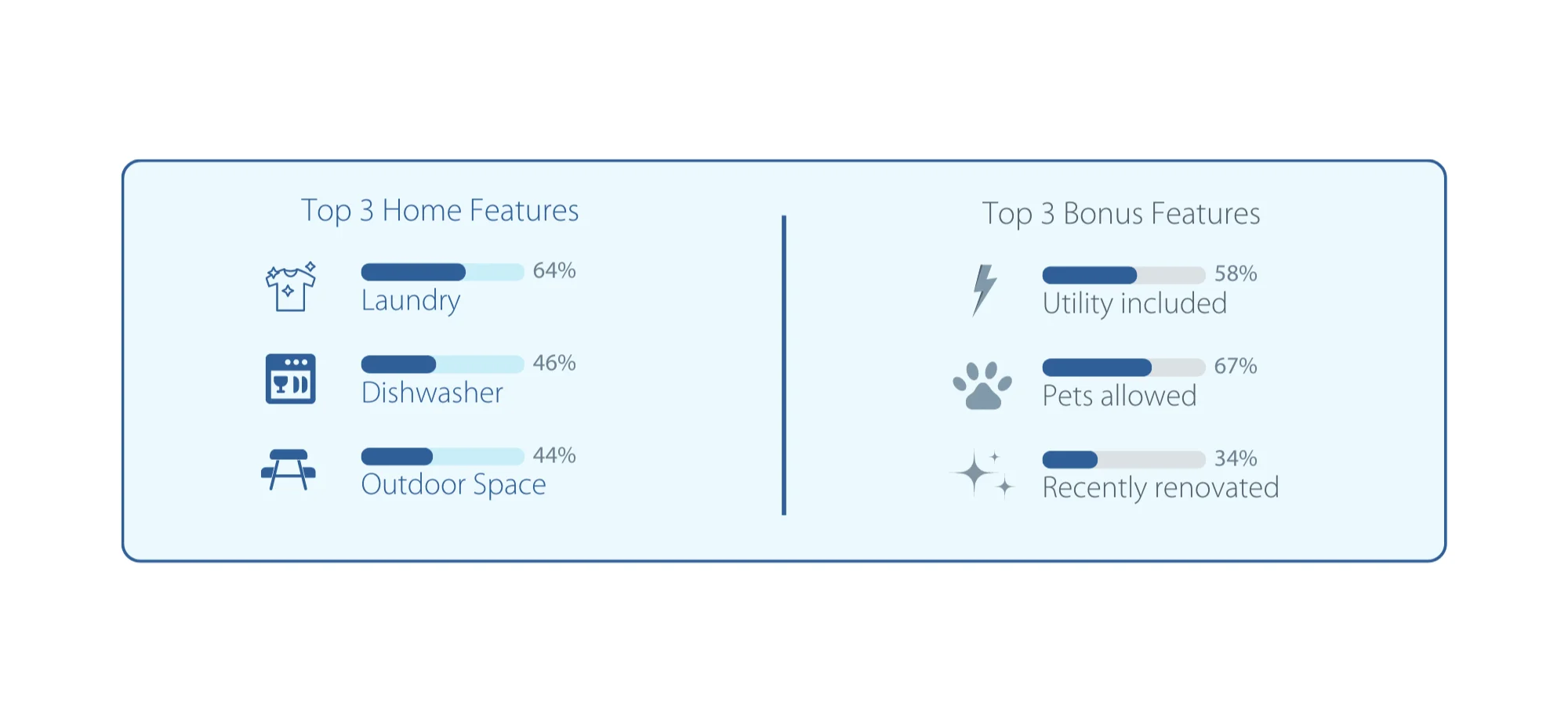

When it comes to amenities, convenience and relaxation are key. Gen Zers value laundry access (64%), dishwashers (47%), and outdoor space (44%). Interestingly, Gen Zers who rent their home are 45% more likely than any other age group to say they consider a fireplace is a necessity when selecting a rental home.

When it comes to amenities, convenience and relaxation are key. Gen Zers value laundry access (64%), dishwashers (47%), and outdoor space (44%). Interestingly, Gen Zers who rent their home are 45% more likely than any other age group to say they consider a fireplace is a necessity when selecting a rental home.

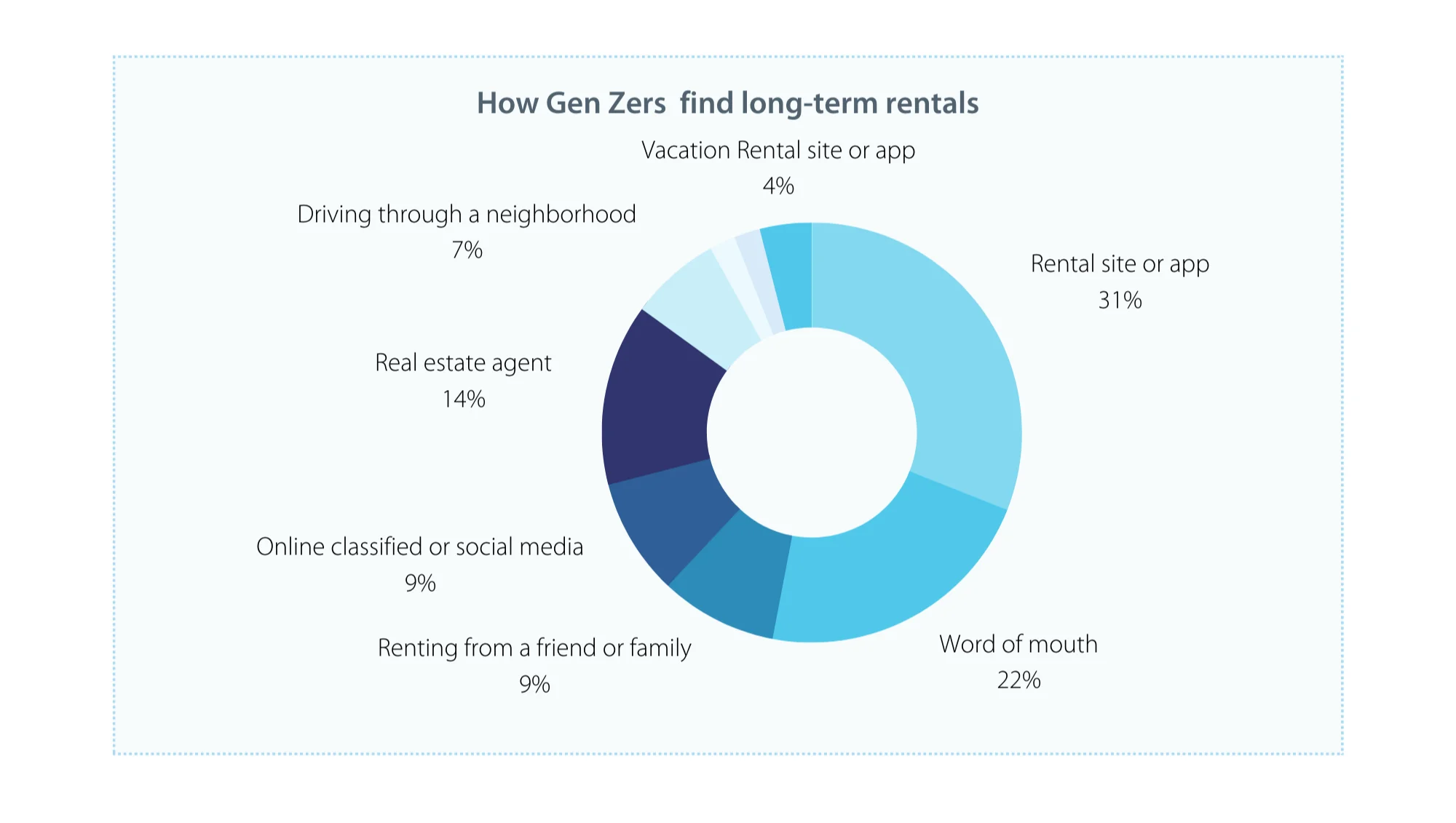

Websites and Wiggle Room

The most common way Gen Zers cited finding their current rental was rental listing sites (31%). Other methods this generation used include Word of Mouth (22%) or a real estate agent (14%). In order to reach Gen Zers, consider listing your rental on sites like Zillow and Redfin.

U.S. Gen Zers who rent their home are 54% more likely than any other age group to say the biggest downside of renting a home is little to no flexibility in making changes to the home. This generation prioritizes flexibility, so allowing small and/or reversible changes in your rental may help you attract more Zoomers.

Overall Findings

Clearly, tenant preferences vary by generation. Landlords can use generational data to make informed purchases of new properties, market existing properties, and create a sound tenant retention strategy. Baby Boomers, Millennials, and Gen Zers are all viable tenants, and each group has their individual advantages. Buy and hold investors can play to their property strengths.

For example, if your property is in a fantastic school zone, consider targeting millennials. Or if your property is in a quiet neighborhood, consider targeting Boomers. It is also important to note that there are some universal preferences. For instance, all three age groups said laundry in-unit or on-site is a necessity. The key here is to use this data to support and supplement existing strategies, and not as standalone data points.

Survey Methodology & Definitions

The findings presented in this article are the result of a January 2023 study of 1,752 U.S. adults who currently live in a long-term rental, conducted by Visio Lending. (Confidence Level: 95%, Margin of Error: 2%)

Audience Definitions

- Audience: U.S. adults who currently live in a long-term rental

– Long-term rental: single-family home, condominium, townhome, duplex, triplex, or quadplex

– Adult: 18+

Balanced for gender, ethnicity, geographic location, and annual household income

See additional survey data here.

Related: Why Do Lenders Require Rent Roll?