-min.png?width=600&height=338&name=1%20-%20Blog%20Feature%20Image%20Dump%20(2)-min.png)

Landlord insurance is a completely different ballgame than homeowners insurance. In fact, homeowners insurance only covers owner-occupied single-family residences, which means if your home is occupied by tenants, you are not covered and might as well not have insurance at all.

That’s why for properties rented out on a long-term basis, landlord insurance is essential. Though it may seem like a daunting topic, we have broken down everything you need to know in this comprehensive landlord insurance guide including:

- What is landlord insurance?

- What types of policies are there?

- Umbrella policies for added liability

- Common pitfalls to look out for

- Renters insurance & tenant coverage

Click to Download Landlord Insurance: The Ultimate Guide

What is Landlord Insurance?

Landlord insurance is a type of insurance designed for rental units. Though they are 20-30% more expensive than a standard homeowners insurance policy, landlord policies include the extended landlord insurance coverage landlords needed.

Most basic landlord insurance policies offer property protection and liability protection. Typically, property protection covers the structures of rental property, and other structures on the property such as a garage or fence. Sometimes it also protects the landlord’s personal property, such as furniture you may have or your lawnmower. Liability coverage helps with medical expenses and legal fees if someone is injured on your rental property. As a landlord, you have responsibility for injuries on your property, so an extra layer of liability protection is essential.

Keep in mind, we said the most basic policies offer property and liability protection. To fully protect your assets and investment, you are going to want additional coverage. Let’s dive into your options more closely.

Types of Landlord Insurance Policies

When you’re looking for a landlord insurance policy, you’ll typically come across the term “Dwelling Policy,” which is a policy used to cover homes that are not occupied by the owner (perfect for a rental property). While dwelling policies vary by insurance provider, there are typically three levels of policies you’ll encounter: DP-1, DP-2, and DP-3.

DP-1 Policy

A DP-1 policy is the most basic policy. It only covers the Actual Cash Value of the property, which is the replacement cost minus depreciation (this can really add up) or the depreciated rebuild value. Let's put that in plain English. With a DP-1 policy, you will not have enough coverage to replace a destroyed rental property if the cost to rebuild the home exceeds the value of the home immediately prior to its destruction. A DP-1 policy also excludes Rent Loss Insurance. This means that if you are unable to rent out your property due to a fire, flood, or guest damage, your rental income will not be covered.

Another level of insurance coverage that is excluded from DP-1 policies is needed perils. A DP-1 policy is a named peril policy, which means it specifically lists covered perils. In other words, everything that isn’t listed is not covered, as opposed to an open peril policy, which covers all possible perils with a small list of exclusions. Here are some of the common perils protected by a DP-1:

- Fire and Lighting

- Windstorm and Hail

- Riot and Civil Commotion

- Smoke

- Aircraft

- Vehicles

- Vandalism and Malicious Mischief

DP-2 Policy

The DP-2 policy is the middle-ground policy. It is more expensive and includes more coverage than a DP-1 policy. One key differentiating factor is that a DP-2 policy will include Replacement Cost Coverage, instead of Actual Cash Value. This means you’re more likely to have enough coverage if the cost to repair or rebuild the property exceeds what the property was worth prior to the damage. Some DP-2 policies will even include Loss of Rent Coverage, though not always.

Like a DP-1 policy, a DP-2 policy is a named peril insurance policy, yet with more listed perils. It is common for a DP-2 policy to include:

- All above listed DP-1 perils

- Internal and External Explosion

- Riot

- Glass Breakage

- Accidental Discharge or Overflow of Water

- Falling Objects

- Freezing Pipes

- Electrical Damage

- Collapse

- Tearing Apart, Cracking, Burning Bulging

DP-3 Policy

The DP-3 is the most expensive policy because it has by far the best coverage. Loss of Rent Coverage and Replacement Cost Coverage are standard for DP-3 policies. Additionally, a DP-3 policy is an open peril policy and covers ALL perils except for a small exclusion list. Some of the perils that might be on the exclusion list are:

- Neglect

- War

- Nuclear Hazard

- Governmental Action

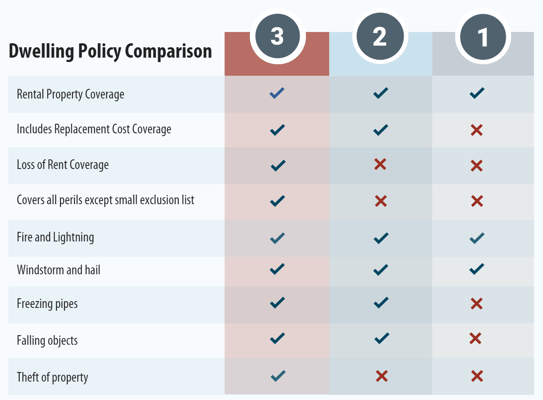

Comparing Policy Types

As we stated, policies always vary by insurance provider, yet most DP-1 and DP-2 policies have missing peril coverage that is essential. If you have a DP-1 or DP-2 policy, Visio Lending requires extended coverage for fire, lightning, internal & external commotion, smoke, aircraft & vehicles, riots, vandalism & malicious mischief, volcanic eruption (for CA, HI, OR, or WA), and sinkholes (for FL). Even though your DP-1 and DP-2 policies are more affordable, the extended coverage can add up. The chart below offers a visual guide for why the DP-3 Policy provides optimal coverage.

Get an Umbrella Policy for Added Liability Coverage

While most landlord insurance policies (even DP-1s) include liability coverage, there are limits to the amount you are covered. Though it varies by policy, standard rental policies are often capped at $500,000 of liability coverage or less. That may sound like a lot of money, but the reality is lawsuits can add up and landlords are at a greater risk of being sued. In one case, a Portland tenant won a $20 million lawsuit against his landlord for safety hazards. So how can landlords who own multiple properties better protect their assets? This is where umbrella policies come into play.

What is an Umbrella Policy?

An umbrella policy offers liability protection beyond your standard dwelling policy with the simplest policies starting at an extra $1 million in coverage. Even though umbrella policies can be considered “worst-case scenario” coverage, think of it this way. How much of your net worth do you want to be protected?

In addition to the added financial protection, umbrella policies offer an extra layer of claims coverage that are generally excluded from standard policies. These include libel (written false statements damaging to a person’s reputation - watch out for social media!), slander (spoken false statements damaging to a person’s reputation), and mental anguish (a high degree of emotional pain, distress, or suffering that is a direct result of a traumatic event). Plus, umbrella policies cover personal circumstances outside of your rental properties, such as your dog biting someone at the park.

Umbrella policies are a good option for landlords looking for additional peace of mind and coverage. We always recommend consulting professionals to find what is right for you.

Common Landlord Insurance Pitfalls to Avoid

So now you know the basics of landlord insurance. Let’s move on to avoiding common pitfalls with landlord insurance.

Water damage often has the most exclusions.

Water damage such as flood damage, standing water, drain and sewage back up, and the source of the water damage (such as a roof leak) are often excluded from a Water Damage Policy. It is important to read the fine print on all the policies and work with professionals to avoid lack of coverage disasters. Water damage can cost upwards of $30,000, which would preferably be covered by insurance. Insurance providers can help you understand what your coverage limits are and may recommend a flood insurance policy in addition to your landlord insurance.

Vacant properties are usually not covered.

Watch out for this one! Even if you have the most optimal, highest amount of coverage, it might not be applicable if your property is vacant. Talk to an insurance company about vacancy insurance or guaranteed income insurance to protect your rental income.

Acting as your own contractor may not be covered.

For those contractors who run rental properties, pay attention. A separate insurance policy is crucial when acting as a contractor. If there is a construction-related injury on the property and the landlord is the contractor, landlord liability insurance probably will NOT kick in.

Renters Insurance is Important to Landlords

So far, we've discussed in detail what landlords need to look out for when buying landlord insurance, but what about tenants? This may surprise you, but making sure your tenants have a sound Renter’s Insurance policy benefits them as well as you. Renters Insurance provides a full spectrum of coverage for many occurrences that are more common than you think. In fact, we always recommend including it as mandatory in your lease agreement. Here is a brief overview of what is covered and how it differs or supplements a landlord policy.

Covers the tenants’ personal property.

In the instance of a robbery, smoke, fire, or storm, a landlord insurance policy typically will not cover the tenant's personal belongings. That means that the tenant will solely be responsible for replacing everything from clothing, furniture, computers, and phones themselves. Landlords should encourage their tenants to have full coverage for their items. Especially because if the tenant is in a bind and cannot pay for their belongings, they are going to approach the landlord for payment.

Provides liability coverage.

Let’s say the tenant’s child throws a baseball through the window or the tenant falls asleep in the tub and overflows it. Although accidents, both these scenarios would be seen as the tenant’s fault and, therefore, Renters Insurance would cover the costs of damage. Additionally, if the tenant has a guest injured on the property, Renters Insurance often covers associated medical costs. Liability coverage in Renters Insurance policies can supplement your landlord policy and, in many cases, be the first line of payments.

Provides loss of use coverage.

If there is a natural disaster and the dwelling is no longer habitable, Renters Insurance will cover temporary housing for tenants. Rather than cover housing costs for tenants, strong landlord insurance policies cover Loss of Income for a dwelling that cannot be rented out.

Covers third-party property damage.

Let's say this time the tenant's child throws a baseball through the neighbor's window or the tenant drives their car through the neighbor's fence. Again, both incidents would be accidents, but the tenant would be at fault. Landlords can take comfort in knowing that Renters Insurance will supplement their landlord policies when the neighbors come for property damage payments.

Luckily, Renters Insurance is very affordable. Apartments.com Product Manager Lucas Hall recommends landlords require tenants in the lease to get a minimum of $100,000 in liability coverage and $15,000 in personal property coverage.

Landlord Insurance FAQS

Here are some of the frequently asked questions we get about landlord insurance?

What kind of insurance do I need for a vacation rental property?

Similar to a long-term rental property, homeowners insurance does not cover vacation rentals. Talk to an insurance agent about getting a landlord insurance policy. One difference between long-term rentals is that short-term tenants do not need any insurance policy themselves.

How much does landlord insurance cost?

Typically, landlord insurance costs 20-30% more than homeowners insurance. The more expensive landlord insurance covers more perils, which means less out of pocket costs in the case of an emergency. Though landlord insurance is more expensive than homeowners insurance, it is so important for property owners to protect their investments. Even if you don't have irresponsible tenants, most people take better care of owner occupied homes than rentals.

What additional coverage should I look at besides my landlord insurance policy?

Depending on the policy and the location of your rental property, you should look into flood insurance, dwelling fire insurance, lost income coverage, and vandalism protection. Talk to an insurance company about all the necessary coverage.

What is a good resource for landlord insurance?

In addition to talking to multiple insurance providers, we recommend visiting the Insurance Information Institute at iii.org.

Landlord Insurance is a Critical Piece for Real Estate Investors

Your investment properties are investments. Protect them with the highest level of coverage so you can continue to grow your rental portfolio with your existing assets secured.

Visio Lending is a trusted partner for professional investors looking to build wealth through rental properties. We’ve funded over $1 billion in rental loans and have the team, technology, and expertise to help you thrive.

Get in touch to get started today.

…

Additional Resources

- Here are some of our favorite resources on landlord insurance:

- The Ultimate Guide to Renters Insurance by Landlordology

- A Quick Guide to Landlord Insurance by Investopedia

- Find more information on Landlording, Landlord Insurance, and more by checking out our most recent Investor Resources.